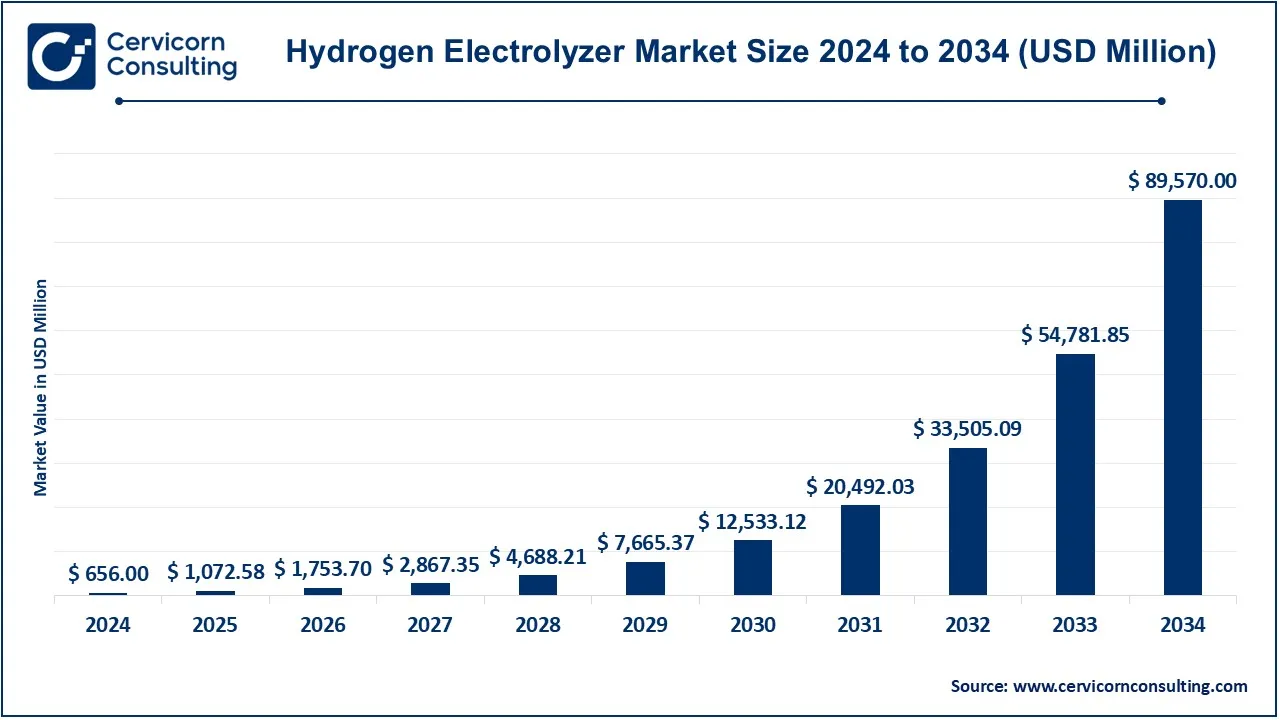

The global hydrogen electrolyzer market size was valued at USD 656 million in 2024 and is expected to be worth around USD 89,570 million by 2034, growing at a compound annual growth rate (CAGR) of 92.11% over the forecast period 2025 to 2034.

The hydrogen electrolyzer market is experiencing rapid growth due to increasing investments in green hydrogen and government initiatives supporting clean energy. Countries worldwide are setting net-zero emissions targets, pushing industries to shift from fossil fuels to hydrogen-based solutions. The demand for zero-emission fuels in industries such as transportation, steel, and chemical manufacturing is driving adoption. Additionally, advancements in electrolyzer efficiency and declining costs of renewable energy are making hydrogen production more viable. The market is also benefiting from increased adoption of hydrogen-powered fuel cells, particularly in the automotive and energy storage sectors. Countries like Germany, Japan, South Korea, and the U.S. are heavily investing in hydrogen infrastructure. Strategic collaborations between companies and government incentives are further accelerating growth.

Electrolyzers work through the process of electrolysis; that is, they split water into hydrogen and oxygen with the aid of electric current. This clean technology is the core for making green hydrogen when the input is from renewable energy sources, most often from solar or wind. The hydrogen thus made can then be put to use as an energy storage, as a source in fuel cells or in industrial processes. A variety of electrolyzers exist and include alkaline, polymer electrolyte membrane (PEM), and solid oxide, with distinctions in efficiency and operational condition. With the ever-increasing appeal for sustainable energy sources, hydrogen electrolyzer is receiving wider recognition as the 'go-to technology' of choice in carbon emission cuts across various sectors.

A hydrogen electrolyzer is a device that splits water into hydrogen and oxygen using electricity through a process called electrolysis. It consists of an anode, a cathode, and an electrolyte that facilitates the movement of ions. When electricity is applied, hydrogen gas is produced at the cathode, and oxygen gas is released at the anode. The hydrogen generated can be stored and used as a clean energy source for various applications, including power generation, industrial processes, and transportation.

There are four main types of hydrogen electrolyzers:

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 656 Million |

| Expected Market Size in 2034 | USD 89,570 Million |

| CAGR (2025 to 2034) | 91.11% |

| Dominant Region | Asia-Pacific |

| Expanding Region | North America |

| Key Segments | Product, Capacity, Output Pressure, Application, Region |

| Key Companies | Air Liquide, Ballard Power Systems, Beijing CEI Technology Co., Ltd., Enapter, Gaztransport &,Technigaz, Giner Inc., GreenHydrogen Systems, iGas Energy GmbH, ITM Power Plc, McPhy Energy, Nel Hydrogen, Next Hydrogen, Plug Power Inc., Siemens AG, Tianjin Mainland Hydrogen Equipment Co. Ltd |

The hydrogen electolyzer market is segmented into product, capacity, output pressure and application. Based on product, the market is segmented into PEM electrolyzer, alkaline water electrolyzer, solid oxide electrolyzer and anion exchange membrane. Based on capacity, the market is segmented into low (<500 kW), medium (500 kW to 2 MW) and high (Above 2 MW). Based on output pressure, the market is segmented into low (Upto 10 Bar), medium (10 Bar – 40 Bar) and high (More than 40 Bar). Based on application, the market is segmented into ammonia, methanol, refinery industry, electronics, energy, power to gas and other.

Proton Electrolyte Membrane (PEM) Electrolyzer: In PEM electrolyzers, the electrochemical decomposition of water takes place with a solid polymer electrolyte. However, despite its small size, it possesses an impressive efficiency and good sustained levels of performance under rapid variations, which is highly advantageous for applications with varying charge such as solar and wind energies. PEM electrolyzer has a quick response time to load changes and is designed to be easily expandable which makes it perfect for the production of hydrogen in remote locations where individuals are dispersed.

Hydrogen Electrolyzer Market Revenue Share, By Product, 2024 (%)

| Product | Revenue Share, 2024 (%) |

| Alkaline Electrolyzer (AE) | 36% |

| Proton Exchange Membrane (PEM) | 48% |

| Solid Oxide Electrolyzer (SOE) | 11% |

| Anion Exchange Membrane (AEM) | 5% |

Alkaline Water Electrolyzer: The technology used in alkaline electrolyzers is the most developed, mature, and, commercially, the most available. Alkaline electrolyzer technology employs liquid alkaline potassium hydroxide for facilitating the hydrogen production. Capable of withstanding harsh operating conditions and available at low costs, they are extensively used in hydrogen production plants, particularly those requiring continuous hydrogen output, owing to the size of their capacity.

Solid Oxide Electrolysers: Solid oxide electrolysers are high temperature hydrogen electrolyzers which comprises of a ceramic electrolyte. The performance in solid oxide electrolysis mostly stems from the use of waste heat from other industrial processes, but suffers from durability and material failure problems. It is mainly an academic tool or used in industries where a lot of waste heat is produced.

Ammonia: Hydrogen is a primary feedstock in the manufacture of ammonia, an important agricultural fertilizer. Most of the green hydrogen produced from electrolyzers is now being employed to bring about transformations in industries, specifically in the case of ammonia production which aids in meeting the prevailing environmental regulations and cutting down CO2 emissions from the conventional way of producing ammonia.

Methanol: In the designers of methanol, which is used in chemicals, fuels, and plastics, electrolyzers are important. Green hydrogen is a growing alternative to natural methane in the production of methanol for the industry, thereby improving environmental performance of methanol production.

Refinery Industry: Natural gas is required for several processes in oil refineries such as hydrocracking and desulfurizing. Electrolyzers are one means of providing green hydrogen for refineries to help them meet the growing issues posed by their reliance on natural gas based hydrogen.

Electronics: Hydrogen is incorporated in the production of certain gadgets such as semiconductors and screens within the electronics sector. And more importantly, the use of electrolyzers will assist in producing the ultrapure hydrogen required in such processes without relying on the dirty sources of hydrogen which are more available as the electronics market keeps widening.

Energy: The utilization of hydrogen is in deeper higher role as it is being integrated inside fuel cells and energy storage devices as storage media. It is also vital in to avoid system overloads for energy networks that include a high proportion of variable renewable energy sources.

Power to gas: The power-to-gas principle incorporates the use of electrolysers in excess power converted into hydrogen gas, which is either stored or injected into the gas grid. It helps to balance out intermittent renewable power, improves energy security n and thanks to hydrogen inside the natural gas mixture, it lowers greenhouse gas emissions as well.

Other: Other sectors in which hydrogen electrolysers are used include food processing, metallurgic production, glass making, and pharmaceuticals where hydrogen is required for some manufacturing processes. The electrolyser produced green hydrogen can replace their home used hydrogen for these industries without being a burden to the environment.

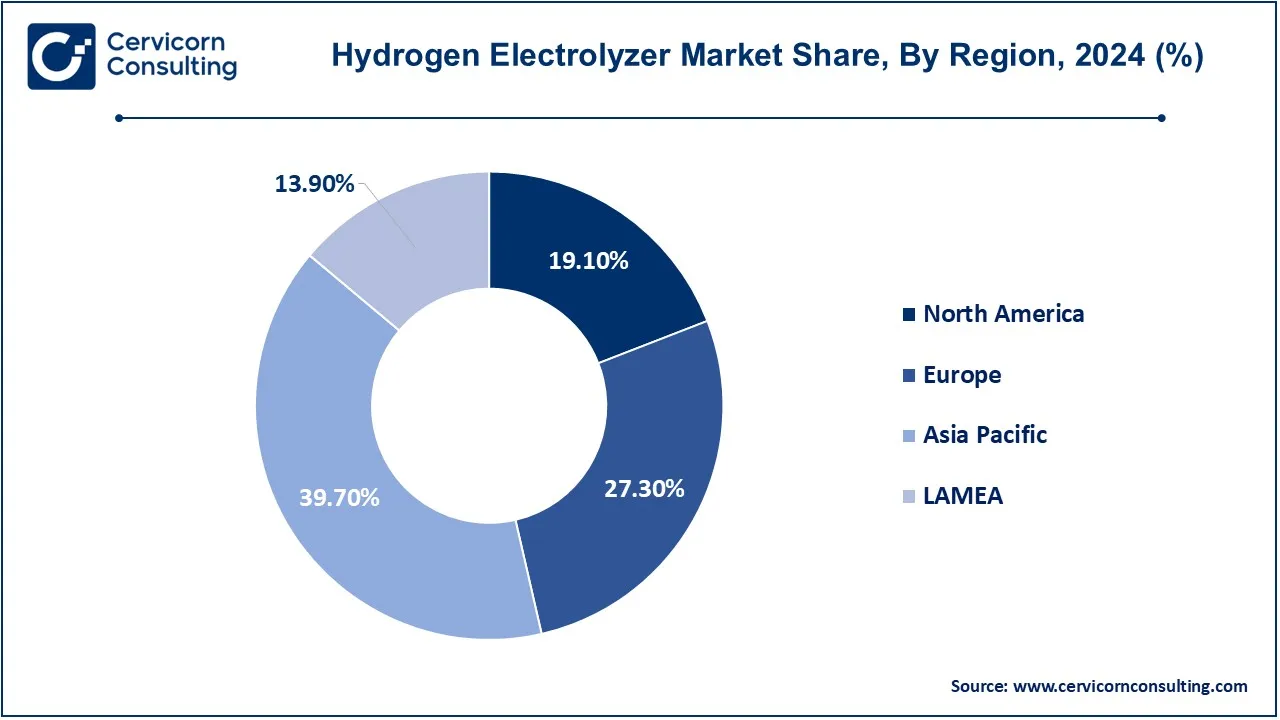

The global market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The Asia-Pacific region has dominated the market in 2024.

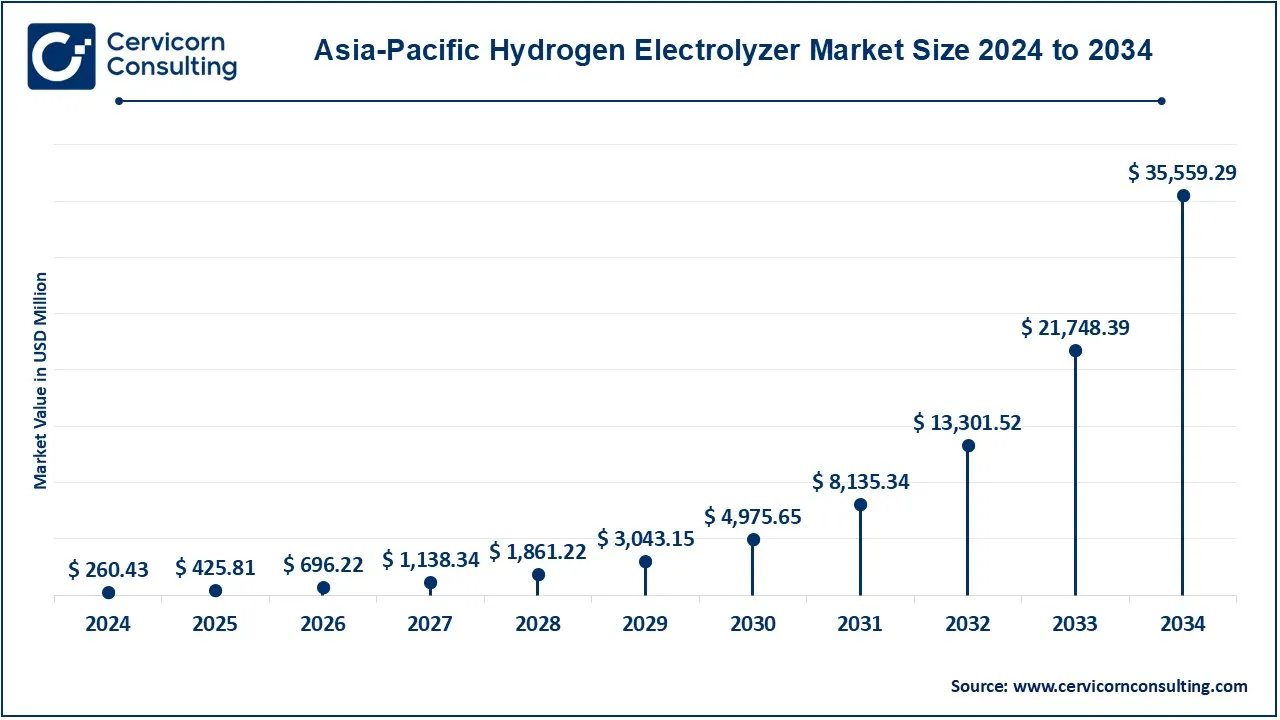

The Asia-Pacific hydrogen electrolyzer market size was valued at USD 260.43 million in 2024 and is expected to be worth around USD 35,559.29 million by 2034. Asia-Pacific is a rapidly growing market, driven by China, Japan, South Korea, and Australia. Japan and South Korea are leaders in hydrogen-powered transportation and fuel cell technologies. China is scaling up hydrogen electrolyzer production for use in the steel and chemical industries. Australia is emerging as a major player with several hydrogen export projects. Regional governments are investing in hydrogen to meet decarbonization goals and reduce dependency on coal and natural gas.

The North America hydrogen electrolyzer market size was valued at USD 125.30 million in 2024 and is expected to reach around USD 17,107.87 million by 2034. The North America is primarily supported by green hydrogen production technologies being developed in the U.S. and Canada. The U.S. government invests heavily in hydrogen technologies under the Infrastructure Investment ad Jobs Act. Canada’s Hydrogen Strategy has an ambitious target of 20 – 90% hydrogen supply across the country. Key applications for these energies are also storage and transport in these countries due to high renewable energy targets and decarbonization in other sectors. These plans are speeding up the hydrogen electrolyzer market growth in the region.

The Europe hydrogen electrolyzer market size was estimated at USD 179.09 million in 2024 and is expected to be worth around USD 24,452.61 million by 2034. Europe is first in the hydrogen electrolyzers market with countries like Germany, France, and the Netherlands taking the lead in green hydrogen projects. Germany’s National Hydrogen Strategy and the French hydrogen plan both work on the development of electrolyzer technology in order to achieve industrial decarbonization. Continuing with this, the Green Deal issued by the European Union empowers additional gender usage of hydrogen in the region. More specific, Germany is highly focused on developing hydrogen production for domestic energy and transport markets as well as for heavy industries to cut down on fossil fuel consumption.

The LAMEA hydrogen electrolyzer market size was valued at USD 91.18 million in 2024 and is expected to be worth around USD 12,450.23 million by 2034. LAMEA is experiencing an increasing interest in hydrogen electrolyzers ranging from Brazil, Chile, Saudi Arabia, and South Africa. In this regard, Chile and Brazil are more concentrated on green hydrogen projects, as they have renewable energies that can be exploited. The Middle East has also brought into focus hydrogen with Saudi Arabia’s NEOM planning to build the world’s largest green hydrogen plant and in South Africa, hydrogen is being looked at as an energy diversification mechanism. The region has an abundance of natural resources that present immense opportunities for the production and export of hydrogen at a commercial scale.

CEO Statements

Paul Barrett, CEO of Hysata

Stefan Höller, CEO of Hoeller Electrolyzer GmbH

Mats Blacker, CEO of Hymeth

Market Segmentation

By Product

By Capacity

By Output Pressure

By Application

By Regions

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Hydrogen Electrolyzer

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Output Pressure Overview

2.2.3 By Capacity Overview

2.2.4 By Application Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Hydrogen Electrolyzer Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Green Hydrogen Production Growing by Leaps and Bounds

4.1.1.2 Hydrogen Electrolyzers for Power Grid Stability

4.1.1.3 Declining Cost of Renewable Energy

4.1.1.4 Adoption of National Hydrogen Strategies

4.1.2 Market Restraints

4.1.2.1 High Initial Capital Cost of Electrolyzers

4.1.2.2 Lack of Hydrogen Infrastructure

4.1.2.3 Technology Limitations of Large-Scale Projects

4.1.3 Market Challenges

4.1.3.1 High Operational Costs

4.1.3.2 Unavailability of Cheap Renewable Energy

4.1.3.3 Threat from Competing Modes

4.1.3.4 Deficiency of Trained Personnel

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Hydrogen Electrolyzer Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Hydrogen Electrolyzer Market, By Product

6.1 Global Hydrogen Electrolyzer Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Proton Electrolyte Membrane (PEM) Electrolyzer

6.1.1.2 Alkaline Water Electrolyzer

6.1.1.3 Solid Oxide Electrolyzer

6.1.1.4 AEM

Chapter 7. Hydrogen Electrolyzer Market, By Capacity

7.1 Global Hydrogen Electrolyzer Market Snapshot, By Capacity

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Low (<500 kW)

7.1.1.2 Medium (500 kW to 2 MW)

7.1.1.3 High (Above 2 MW)

Chapter 8. Hydrogen Electrolyzer Market, By Output Pressure

8.1 Global Hydrogen Electrolyzer Market Snapshot, By Output Pressure

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Low (Upto 10 Bar)

8.1.1.2 Medium (10 Bar – 40 Bar)

8.1.1.3 High (More than 40 Bar)

Chapter 9. Hydrogen Electrolyzer Market, By Application

9.1 Global Hydrogen Electrolyzer Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Ammonia

9.1.1.2 Methanol

9.1.1.3 Refinery Industry

9.1.1.4 Electronics

9.1.1.5 Energy

9.1.1.6 Power to Gas

9.1.1.7 Others

Chapter 10. Hydrogen Electrolyzer Market, By Region

10.1 Overview

10.2 Hydrogen Electrolyzer Market Revenue Share, By Region 2024 (%)

10.3 Global Hydrogen Electrolyzer Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Hydrogen Electrolyzer Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Hydrogen Electrolyzer Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Hydrogen Electrolyzer Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Hydrogen Electrolyzer Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Hydrogen Electrolyzer Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Hydrogen Electrolyzer Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Hydrogen Electrolyzer Market, By Country

10.5.4 UK

10.5.4.1 UK Hydrogen Electrolyzer Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Hydrogen Electrolyzer Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Hydrogen Electrolyzer Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Hydrogen Electrolyzer Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Hydrogen Electrolyzer Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Hydrogen Electrolyzer Market, By Country

10.6.4 China

10.6.4.1 China Hydrogen Electrolyzer Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Hydrogen Electrolyzer Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Hydrogen Electrolyzer Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Hydrogen Electrolyzer Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Hydrogen Electrolyzer Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Hydrogen Electrolyzer Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Hydrogen Electrolyzer Market, By Country

10.7.4 GCC

10.7.4.1 GCC Hydrogen Electrolyzer Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Hydrogen Electrolyzer Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Hydrogen Electrolyzer Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Hydrogen Electrolyzer Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Air Liquide

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Ballard Power Systems

12.3 Beijing CEI Technology Co. Ltd.

12.4 Enapter

12.5 Gaztransport & Technigaz

12.6 Giner Inc.

12.7 Green Hydrogen Systems

12.8 iGas Energy GmbH

12.9 ITM Power Plc

12.10 McPhy Energy

12.11 Nel Hydrogen

12.12 Next Hydrogen

12.13 Plug Power Inc.

12.14 Siemens AG

12.15 Tianjin Mainland Hydrogen Equipment Co. Ltd