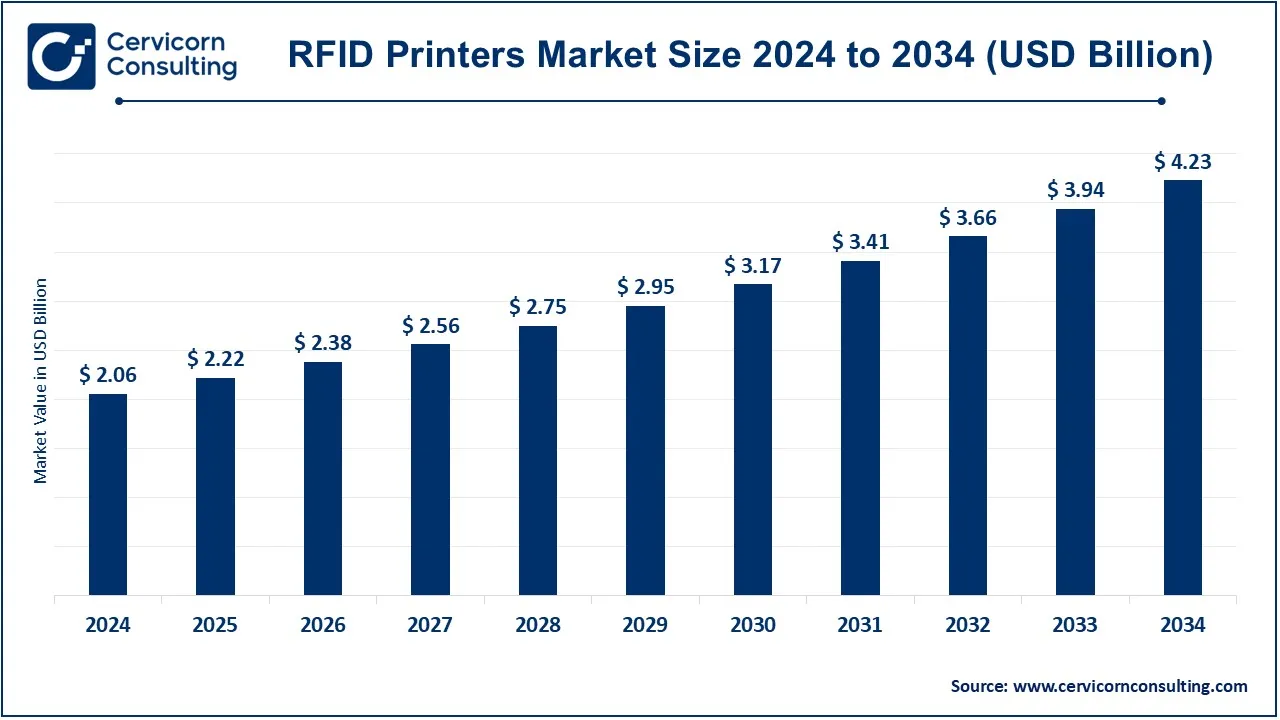

The global RFID printers market size was reached at USD 2.06 billion in 2024 and is expected to be worth around USD 4.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.60% from 2025 to 2034.

The RFID printer market has been experiencing steady growth due to increasing demand for automated tracking systems, real-time inventory management, and supply chain optimization. The widespread adoption of Internet of Things (IoT), Industry 4.0, and smart manufacturing has further fueled the need for RFID printing solutions. Retailers, logistics companies, and healthcare providers are investing in RFID printers to reduce labor costs, enhance security, and improve operational efficiency. Government regulations mandating RFID usage in sectors like pharmaceuticals and food safety are also boosting market expansion. The rise of e-commerce and warehouse automation has led to increased RFID adoption in logistics and distribution centers. With ongoing advancements in RFID technology, cloud integration, and AI-driven tracking, the market is expected to see further innovation and wider adoption across industries.

An RFID printer is a specialized printer that encodes, prints, and verifies RFID (Radio Frequency Identification) tags or labels. Unlike traditional label printers, RFID printers use radio waves to write data onto an embedded RFID chip while simultaneously printing human-readable information on the label. These printers are commonly used in industries like logistics, healthcare, retail, and manufacturing to improve tracking, reduce errors, and enhance automation. RFID printers work by integrating an RFID reader and encoder within the printing mechanism. They encode unique data onto RFID chips inside labels or tags, which can then be scanned without direct line-of-sight, making them highly efficient for asset tracking and inventory management.

Key Insights related to the RFID:

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 2.06 Billion |

| Projected Market Size in 2034 | USD 4.23 Billion |

| CAGR (2025 to 2034) | 7.60% |

| Dominant Region | North America |

| Fast-Developing Region | Asia-Pacific |

| Key Segments | Type, Printing Type, End User, Region |

| Key Companies | Zebra Technologies Corporation, Sato Holdings Corporation, Honeywell International Inc, Toshiba Corp., Avery Dennison Corporation, Seiko Epson Corporation, Dascom, Printronix Auto ID, ID Technology LLC, BOCA systems |

The RFID printers market is segmented into type, printing type, end user, and region. Based on type, the market is classified into desktop, industrial and mobile. Based on printing type, the market is classified into direct thermal and thermal transfer. Based on end user, the market is classified into retail and consumer goods, manufacturing, healthcare, transportation and logistics and others.

Desktop RFID Printer: Desktop RFID printers are compact and primarily designed for low to medium volume printing tasks. They are ideal for businesses that require space-efficient printers, such as retail stores and small warehouses. These printers provide cost-effective RFID label printing, offering ease of use and flexible deployment options. Due to their smaller size and relatively lower cost, they are widely adopted by smaller businesses and sectors like healthcare for item tracking.

Industrial RFID Printer: Industrial RFID printers are designed for high-volume, demanding environments, offering robust, durable construction and high-speed printing capabilities. These printers are essential in large-scale operations such as manufacturing plants, logistics centers, and distribution hubs. They provide superior performance, handling heavy-duty RFID tag printing with greater efficiency. Due to their enhanced durability and functionality, they are ideal for continuous use in harsh industrial environments where high reliability is critical.

RFID Printers Market Revenue Share, By Type, 2024 (%)

| Type | Revenue Share, 2024 (%) |

| Desktop RFID Printer | 49% |

| Industrial RFID Printer | 37% |

| Mobile RFID Printer | 14% |

Others: This category includes specialized RFID printers such as mobile RFID printers and RFID encoders. These devices cater to niche applications where mobility or specific functionality, like encoding complex data on RFID tags, is required. Mobile RFID printers are often used in field operations, while RFID encoders are leveraged for more complex tasks such as creating secure, encrypted tags. These printers target sectors like field services, mobile asset tracking, and security industries.

Retail and Consumer Goods: RFID printers play a crucial role in retail and consumer goods, enabling businesses to streamline inventory management, track product movement, and reduce losses due to theft or misplaced items. They allow retailers to enhance efficiency in stock replenishment, supply chain visibility, and customer service. By printing RFID tags for items, retailers can automate many processes, improving the overall shopping experience and operational transparency.

Manufacturing: In manufacturing, RFID printers are used to generate tags for tracking raw materials, work-in-progress items, and finished goods. These tags enable manufacturers to optimize production workflows, monitor assets in real-time, and enhance quality control. RFID technology is essential for reducing human error, ensuring compliance with regulations, and improving overall productivity in the manufacturing environment, particularly in industries like automotive and electronics.

Healthcare: The healthcare sector benefits from RFID printers by using them to produce tags for medical equipment, patient records, and medication tracking. RFID-enabled healthcare systems improve patient safety by reducing medication errors and ensuring accurate patient identification. Additionally, hospitals use RFID tags to monitor the usage and location of critical medical equipment, thereby increasing operational efficiency and improving patient care.

Transportation and Logistics: RFID printers are essential in transportation and logistics, where they are used to tag shipments, pallets, and containers. These tags enable real-time tracking of goods, improving supply chain visibility and reducing losses due to mismanagement. In the logistics sector, RFID technology helps optimize warehouse management, streamline loading and unloading processes, and enhance delivery accuracy. It is critical for global trade and e-commerce industries.

Others: Other industries such as government, education, and security also leverage RFID printers for a variety of applications. Governments use RFID for asset tracking and identification, while educational institutions may employ them for library management or campus security. In the security sector, RFID tags produced by specialized printers are used for access control systems, allowing organizations to enhance safety and control over sensitive areas.

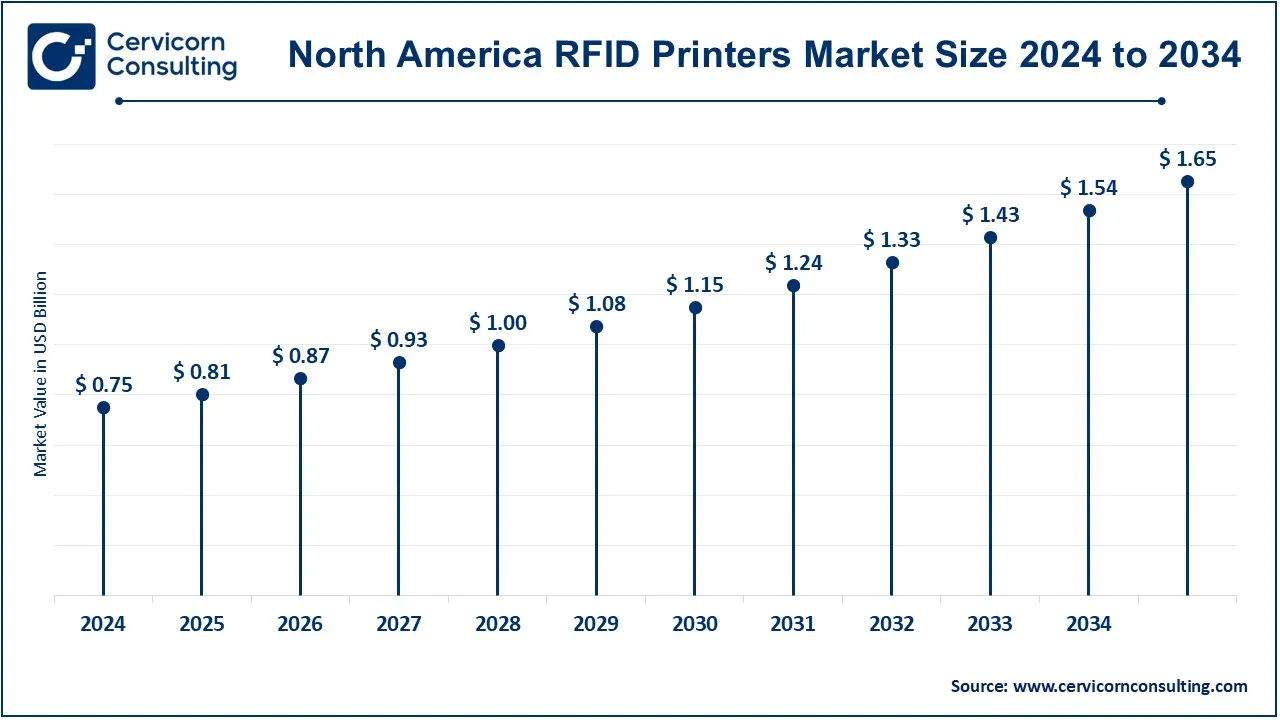

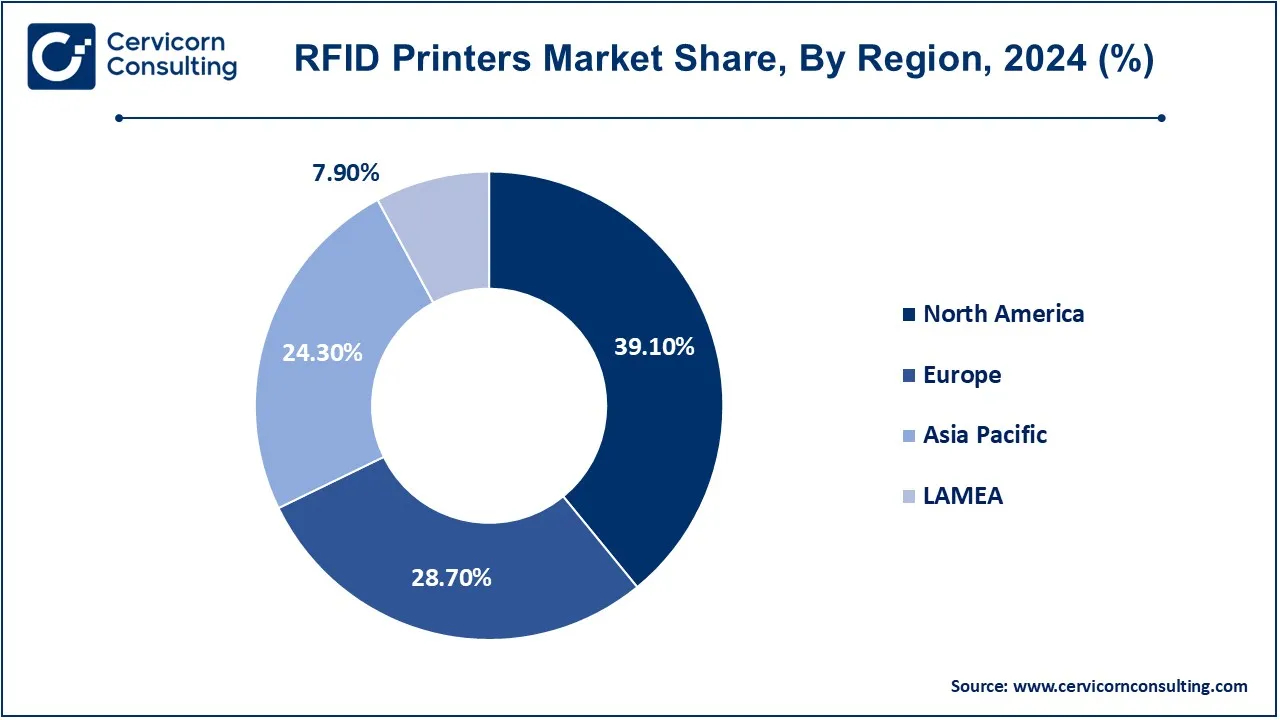

The RFID printers market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The North America has dominated the market in 2024.

The North America RFID printers market size was valued at USD 0.75 billion in 2024 and is expected to reach around USD 1.65 billion by 2034. The North America market is driven by strong demand in industries like retail, healthcare, and manufacturing. The U.S. and Canada are leading adopters of RFID technology due to the increasing emphasis on automation, inventory management, and supply chain efficiency. The U.S., being home to major retail giants like Walmart and Amazon, plays a pivotal role in RFID deployment. Canada is also witnessing growth in healthcare applications for better patient management and asset tracking, further boosting the regional market.

The Europe RFID printers market size was estimated at USD 0.55 billion in 2024 and is projected to hit around USD 1.21 billion by 2034. Europe's market is led by countries such as Germany, the U.K., and France. The region has seen extensive adoption of RFID technology in manufacturing and automotive industries, especially in Germany. The European Union’s stringent regulatory policies regarding product tracking, safety, and quality control have also prompted industries to adopt RFID technology widely. The U.K. and France are emerging markets for RFID in retail and logistics, focusing on enhancing supply chain transparency and inventory management.

The Asia-Pacific RFID printers market size was accounted for USD 0.47 billion in 2024 and is predicted to surpass around USD 1.03 billion by 2034. Asia-Pacific is witnessing rapid growth in the RFID printers market, primarily due to the booming manufacturing and logistics sectors in China, Japan, and India. China leads the market with its strong industrial base and significant investment in supply chain automation. Japan, known for its technological advancements, is also adopting RFID technology in the retail and healthcare sectors. India is emerging as a key market due to the expansion of organized retail and increasing government initiatives in improving supply chain efficiency.

The LAMEA RFID printers market was valued at USD 0.16 billion in 2024 and is anticipated to reach around USD 0.33 billion by 2034. LAMEA is growing steadily, with Brazil, Mexico, and South Africa leading the charge. In Latin America, Brazil and Mexico are seeing RFID technology adoption in retail and transportation sectors. The Middle East, led by countries like the UAE and Saudi Arabia, is increasingly using RFID in logistics and healthcare to improve operational efficiency. In Africa, South Africa is spearheading the use of RFID technology in government, retail, and industrial applications, although the market is still in its nascent stages.

CEO Statements

Hiroyuki Konuma, CEO of Sato Holdings Corporation

Bill Burns, CEO of Zebra Technologies

Darius Adamczyk, CEO of Honeywell International

Recent product launches in the RFID printers market highlight a significant trend toward innovation and strategic partnerships among major industry players. Companies like Zebra Technologies, Sato Holdings, Honeywell International, and Toshiba are actively developing advanced printing technologies to cater to the rising demand for efficient and accurate inventory management, particularly in retail and healthcare sectors. Innovations such as integrated barcode verification and enhanced RFID encoding capabilities are being prioritized to improve operational efficiency and accuracy. These advancements reflect a broader commitment to enhancing supply chain logistics and addressing the evolving needs of various industries. Some notable examples of key developments in the RFID printers Market include:

Market Segmentation

By Type

By Printing Type

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of RFID Printers

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Tyre Overview

2.2.2 By Printing Type Overview

2.2.3 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on RFID Printers Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Growing Demand for Real-time Data

4.1.1.2 RFID in Aviation

4.1.1.3 Adoption in Cold Chain

4.1.2 Market Restraints

4.1.2.1 High Initial Investment

4.1.2.2 Interference Issues

4.1.2.3 Data Privacy Concerns

4.1.3 Market Challenges

4.1.3.1 High Cost of RFID Tags

4.1.3.2 Lack of Skilled Workforce

4.1.3.3 Evolving Technology

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global RFID Printers Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. RFID Printers Market, By Type

6.1 Global RFID Printers Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Desktop RFID Printer

6.1.1.2 Industrial RFID Printer

6.1.1.3 Mobile RFID Printer

Chapter 7. RFID Printers Market, By Printing Type

7.1 Global RFID Printers Market Snapshot, By Printing Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Direct Thermal

7.1.1.2 Thermal Transfer

Chapter 8. RFID Printers Market, By End User

8.1 Global RFID Printers Market Snapshot, By End User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Retail and Consumer Goods

8.1.1.2 Manufacturing

8.1.1.3 Healthcare

8.1.1.4 Transportation and logistics

8.1.1.5 Others

Chapter 9. RFID Printers Market, By Region

9.1 Overview

9.2 RFID Printers Market Revenue Share, By Region 2024 (%)

9.3 Global RFID Printers Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America RFID Printers Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America RFID Printers Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. RFID Printers Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada RFID Printers Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico RFID Printers Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe RFID Printers Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe RFID Printers Market, By Country

9.5.4 UK

9.5.4.1 UK RFID Printers Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France RFID Printers Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany RFID Printers Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe RFID Printers Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific RFID Printers Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific RFID Printers Market, By Country

9.6.4 China

9.6.4.1 China RFID Printers Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan RFID Printers Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India RFID Printers Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia RFID Printers Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific RFID Printers Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA RFID Printers Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA RFID Printers Market, By Country

9.7.4 GCC

9.7.4.1 GCC RFID Printers Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa RFID Printers Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil RFID Printers Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA RFID Printers Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Zebra Technologies Corporation

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Sato Holdings Corporation

11.3 Honeywell International Inc

11.4 Toshiba Corp.

11.5 Avery Dennison Corporation

11.6 Seiko Epson Corporation

11.7 Dascom

11.8 Printronix Auto ID

11.9 ID Technology LLC

11.10 BOCA Systems