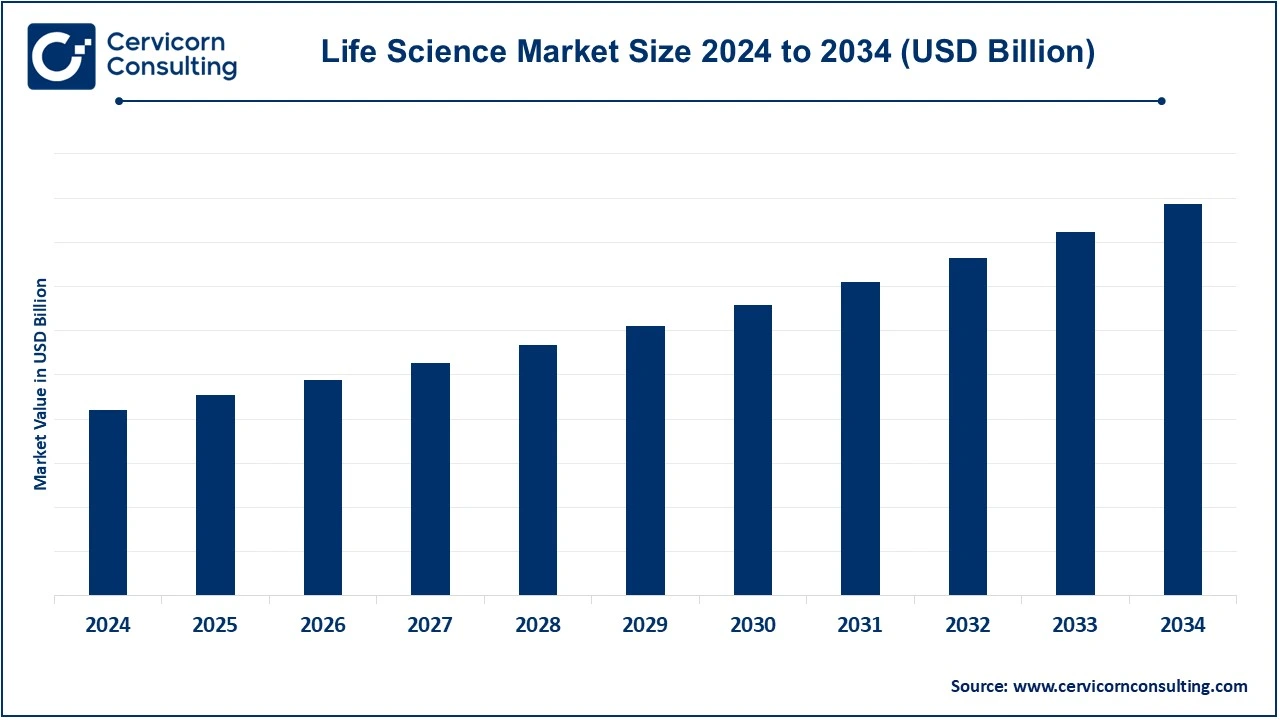

The global life science market is expected to witness growth at a compound annual growth rate (CAGR) of 10.28% over the forecast period 2025 to 2034. Life science encompasses the scientific study of living organisms, including humans, animals, plants, and microorganisms. It involves disciplines such as biology, biotechnology, genetics, molecular biology, and pharmaceuticals, which focus on understanding the mechanisms of life and developing solutions to improve health and sustainability. Life sciences drive innovations in areas like drug discovery, gene therapy, precision medicine, agricultural biotechnology, and diagnostics. These advancements not only improve healthcare but also address global challenges such as food security and environmental sustainability.

The life sciences industry plays a pivotal role in shaping the future of healthcare and technology. With the rapid adoption of technologies like artificial intelligence (AI), CRISPR gene editing, and next-generation sequencing (NGS), the sector is advancing at an unprecedented pace. Post-pandemic, the focus on personalized medicine, early diagnostics, and preventive healthcare has surged, boosting the demand for life sciences applications globally.

The life sciences market is driven by several key factors, including advancements in biotechnology, the growing prevalence of chronic and infectious diseases, and the increasing demand for personalized medicine and biologics. The rise of innovative technologies, such as gene editing tools like CRISPR, next-generation sequencing, and artificial intelligence in drug discovery, is accelerating breakthroughs in research and development. Furthermore, increased government funding, private investments, and partnerships between academia and industry are fostering innovation, while the global aging population and the need for advanced healthcare solutions continue to propel growth in the sector.

The life science market is evolving rapidly, driven by a combination of technological innovations, shifting demographics, and increased demand for personalized healthcare solutions. Below are some key trends currently shaping the life science sector:

Technological Advancements and Digital Transformation

Personalized Medicine and Biotechnology

Growth of Digital Health and Remote Monitoring

Expansion in Emerging Markets

Regulatory Developments and Investment Growth

Report Scope

| Area of Focus | Details |

| Market CAGR 2025 to 2034 | 10.28% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Segments | Type, Therapeutic Areas, Application, End User, Region |

| Key Companies | Thermo Fisher Scientific Inc., Danaher Corporation, Roche Holding AG, Merck KGaA (MilliporeSigma), Pfizer Inc., Johnson & Johnson, Agilent Technologies Inc., Illumina, Inc., Becton, Dickinson and Company (BD), Bio-Rad Laboratories, Inc., Abbott Laboratories, GE HealthCare |

Technological Advancements

Aging Global Population

Growth in Chronic Diseases

Expansion of Personalized Medicine

High R&D and Production Costs

Regulatory Challenges

Intellectual Property (IP) Issues

The life science market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa).

North America, particularly the United States, dominates the global life science industry due to its advanced healthcare infrastructure, high levels of investment in biotechnology, and the presence of leading pharmaceutical and biotechnology companies. The U.S. is home to numerous research institutions, universities, and healthcare providers that contribute to the development of life science technologies and innovations. The increasing demand for healthcare services, especially in areas like oncology, cardiovascular diseases, and diabetes, has bolstered the market. Moreover, the U.S. government’s continuous investment in biomedical research, through organizations like the National Institutes of Health (NIH), supports innovation in the sector. Furthermore, the rising demand for personalized medicine, gene therapies, and cell-based therapies is driving growth in North America. The adoption of advanced technologies such as AI, machine learning, and precision medicine also plays a critical role in the region's leadership.

The presence of major pharmaceutical companies like Pfizer, Johnson & Johnson, and Merck, along with increasing venture capital funding in the biotechnology sector, has made North America a hub for life science research and product development. However, the region faces challenges like high healthcare costs, regulatory complexities, and the threat of generic drugs after patent expirations. Despite these challenges, the market's growth remains strong due to continuous innovation and the expanding healthcare needs of an aging population. In fact, the U.S. Food and Drug Administration (FDA) is expected to approve over 50 new drugs annually, further fueling market expansion.

The Asia Pacific region is emerging as one of the fastest-growing markets in the life science sector. The region’s growth is driven by countries like China, India, Japan, and South Korea, which have large populations, expanding healthcare access, and growing middle-class demand for advanced healthcare services. The Asia Pacific life science market is projected to grow at a CAGR of 12-15% from 2024 to 2033. China's rapid advancements in biotechnology and its robust pharmaceutical industry, including companies like Sinovac and Shanghai Pharmaceuticals, have positioned it as a global leader in life science research and production.

India is also witnessing significant growth in the biotechnology and pharmaceutical sectors, supported by its large and young population, as well as its growing healthcare needs. India is known as the "pharmacy of the world," providing generic drugs to many parts of the globe. The Indian life sciences market is driven by increased investment in research and development. Japan and South Korea are also investing heavily in biotechnology, with Japan focusing on regenerative medicine and stem cell research. The region faces challenges such as varying healthcare standards, regulatory issues, and infrastructure disparities, but its potential for growth is substantial due to an increasingly affluent population and rising healthcare needs.

Life Science Companies Landscape

The life sciences market is highly competitive and innovation-driven, with companies focusing on advancing healthcare, diagnostics, and biotechnology. The landscape is characterized by intense research and development (R&D) efforts, strategic collaborations, and acquisitions to expand product portfolios and global reach. Major players invest heavily in genomics, proteomics, cell therapies, and artificial intelligence to address growing healthcare demands.

The adoption of personalized medicine, gene editing (like CRISPR), and advanced diagnostic tools has intensified competition. Emerging startups and established giants are driving progress in areas such as immunotherapy, vaccine development, and biomanufacturing. Companies are also focusing on automation and digitalization for lab processes, which enhance efficiency and accuracy.

Thermo Fisher Scientific

Danaher Corporation

Roche Holding AG

Pfizer Inc.

Illumina, Inc.

Market Segmentation

By Type

By Applications

By Therapeutic Areas

By End-User

By Geography

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Life Science

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Therapeutic Areas Overview

2.2.3 By Application Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Life Science Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Technological Advancements

4.1.1.2 Aging Global Population

4.1.1.3 Growth in Chronic Diseases

4.1.1.4 Expansion of Personalized Medicine

4.1.2 Market Restraints

4.1.2.1 High R&D and Production Costs

4.1.2.2 Regulatory Challenges

4.1.2.3 Intellectual Property (IP) Issues

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Life Science Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Life Science Market, By Type

6.1 Global Life Science Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Biotechnology

6.1.1.2 Pharmaceuticals

6.1.1.3 Medical Devices

6.1.1.4 Life Science Tools

6.1.1.5 Digital Health Solutions

Chapter 7. Life Science Market, By Applications

7.1 Global Life Science Market Snapshot, By Applications

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Drug Discovery and Development

7.1.1.2 Diagnostics

7.1.1.3 Therapeutics

7.1.1.4 Clinical Trials

7.1.1.5 Research & Development

Chapter 8. Life Science Market, By Therapeutic Areas

8.1 Global Life Science Market Snapshot, By Therapeutic Areas

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Oncology

8.1.1.2 Cardiology

8.1.1.3 Neurology

8.1.1.4 Immunology

8.1.1.5 Rare Diseases

8.1.1.6 Infectious Diseases

8.1.1.7 Others

Chapter 9. Life Science Market, By End User

9.1 Global Life Science Market Snapshot, By End User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Pharmaceutical Companies

9.1.1.2 Biotechnology Companies

9.1.1.3 Academic & Research Institutions

9.1.1.4 Hospitals & Clinics

9.1.1.5 Others

Chapter 10. Life Science Market, By Region

10.1 Overview

10.2 Life Science Market Revenue Share, By Region 2024 (%)

10.3 Global Life Science Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Life Science Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Life Science Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Life Science Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Life Science Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Life Science Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Life Science Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Life Science Market, By Country

10.5.4 UK

10.5.4.1 UK Life Science Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Life Science Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Life Science Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Life Science Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Life Science Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Life Science Market, By Country

10.6.4 China

10.6.4.1 China Life Science Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Life Science Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Life Science Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Life Science Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Life Science Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Life Science Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Life Science Market, By Country

10.7.4 GCC

10.7.4.1 GCC Life Science Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Life Science Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Life Science Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Life Science Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis, By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Thermo Fisher Scientific Inc.

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Danaher Corporation

12.3 Roche Holding AG

12.4 Merck KGaA (MilliporeSigma)

12.5 Pfizer Inc.

12.6 Johnson & Johnson

12.7 Agilent Technologies Inc.

12.8 Illumina, Inc.

12.9 Becton, Dickinson and Company (BD)

12.10 Bio-Rad Laboratories, Inc.

12.11 Abbott Laboratories

12.12 GE HealthCare