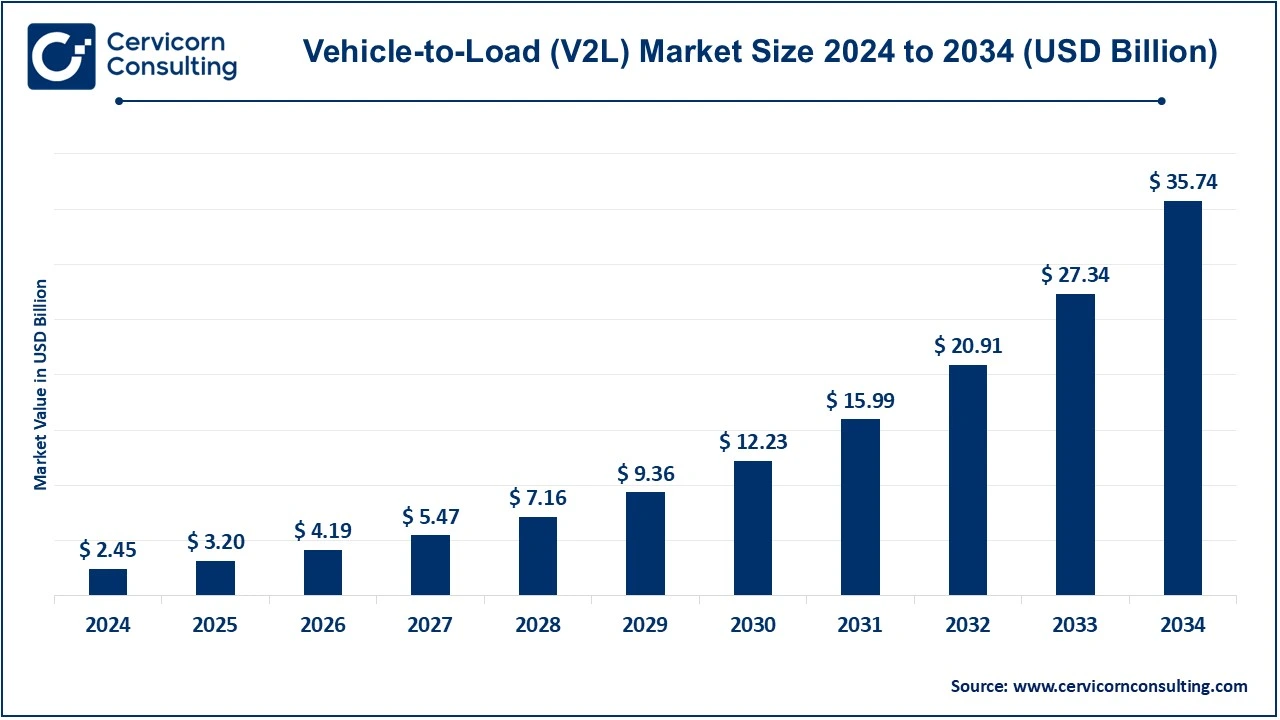

The global vehicle-to-load (V2L) market size was valued at USD 2.45 billion in 2024 and is expected to be worth around USD 35.74 billion by 2034, growing at a compound annual growth rate (CAGR) of 30.95% over the forecast period 2025 to 2034.

The growth of the vehicle-to-load (V2L) market is driven by several key factors, including the rising adoption of electric vehicles (EVs) and the increasing need for portable and backup power solutions. Consumers are seeking EVs with multi-functional capabilities, and V2L enhances their value by enabling power supply for camping, outdoor activities, and emergency use. The rise in power outages due to extreme weather events and growing interest in off-grid living further fuel demand for V2L-equipped EVs. Government incentives and policies promoting EV adoption also contribute to market growth, as automakers integrate V2L to differentiate their models. Advancements in battery technology and energy storage efficiency make V2L more viable, providing longer-lasting and more powerful energy solutions. Additionally, the expansion of renewable energy sources and the push toward sustainable energy ecosystems encourage the use of V2L for home power backup and grid independence.

What is Vehicle-to-Load (V2L)?

Vehicle-to-Load is a technology that allows electric vehicles (EVs) to supply power to external devices, appliances, or even homes. Unlike traditional charging, which only charges the EV, V2L enables the car's battery to act as a mobile power source, providing electricity wherever needed. This feature is particularly useful for outdoor activities like camping, emergency power backup, and even construction sites. V2L works using a built-in inverter that converts the vehicle's stored DC power into AC power, making it compatible with standard electrical appliances. Many modern EVs, such as the Hyundai Ioniq 5, Kia EV6, and Ford F-150 Lightning, support V2L with power outputs ranging from 3.6 kW to 9.6 kW. This feature is becoming increasingly popular as more automakers integrate it into their vehicles. The rise in power outages, off-grid living, and EV adoption is driving the demand for V2L, making it an essential feature for future EVs.

Report Highlights

Key Insights of the Vehicle-to-Load (V2L) Market

Growing Adoption of EVs with V2L Capabilities

Rising Demand for Portable and Emergency Power Solutions

Expansion of V2L into Commercial and Industrial Applications

Integration with Renewable Energy and Smart Grid Systems

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 3.20 Billion |

| Expected Market Size in 2034 | USD 35.74 Billion |

| Estimated CAGR 2025 to 2034 | 30.73% |

| Prime Region | North America |

| Booming Region | Asia-Pacific |

| Key Segments | Vehicle Type, Power Output, Application, End-User, Region |

| Key Companies | Nissan Motor Corporation, Mitsubishi Motors Corporation, Groupe Renault, ENGIE Group, OVO Energy Ltd., Honda Motor Co., Ltd., Hyundai Motor Company, Tesla, Inc., Ford Motor Company, General Motors, Kia Corporation, SUN Mobility |

Increasing Adoption of Electric Vehicles (EVs)

Demand for Portable and Emergency Power Solutions

Infrastructure Challenges

Regulatory Barriers

Integration with Renewable Energy Sources

Development of New Business Models

Technical Challenges

Consumer Awareness and Acceptance

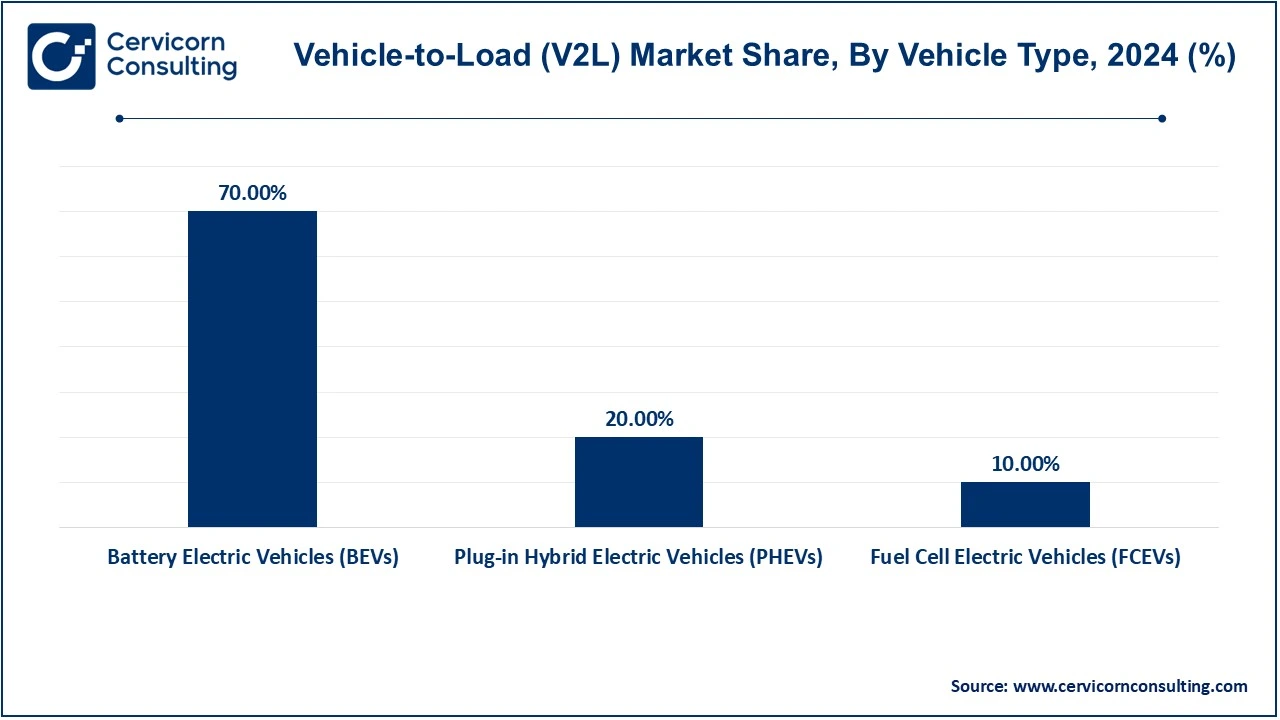

The vehicle-to-load (V2L) market is segmented into vehicle type, power output, application, end-user, and region. Based on vehicle type, the market is classified into battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), fuel cell electric vehicles (FCEVs). Based on power output, the market is classified into low power output (≤3.6 kW), medium power output (3.6 – 7 kW) and high power output (≥7 kW). Based on application, the market is classified into consumer electronics charging, outdoor and camping, emergency backup power and commercial use. Based on end-user, the market is classified into residential users, commercial & industrial users, and government & emergency services.

Battery Electric Vehicles (BEVs): BEVs are leading the V2L market, holding approximately 70% of the revenue share in 2024, and are projected to grow significantly due to increasing EV adoption, favorable government policies, and continuous advancements in battery technology. The ability of battery electric vehicles to store and discharge large amounts of energy makes them highly suitable for V2L applications such as home backup power, outdoor activities, and emergency electricity supply. With EV manufacturers like Tesla, Hyundai, and Ford integrating V2L functionality into their latest models, this segment is expected to expand at a CAGR of 34% from 2025 to 2034. Furthermore, as the cost of lithium-ion batteries declines and their energy density improves, more BEVs will be equipped with V2L, making them an essential component of the distributed energy ecosystem.

Plug-in Hybrid Electric Vehicles (PHEVs): PHEVs offer a blend of electric and fuel-powered operation, making them an attractive option for consumers who want flexibility and extended range. The V2L capabilities in PHEVs are particularly useful for individuals who need reliable power for outdoor adventures or emergency situations. While they currently hold a smaller share than BEVs, the PHEV segment is expected to grow at a CAGR of 28% over the next decade as automakers enhance their battery capacity and increase the adoption of bidirectional charging. Additionally, policies promoting hybrid adoption in regions with limited EV infrastructure will support PHEV market expansion.

Fuel Cell Electric Vehicles (FCEVs): FCEVs, though still in the early stages of adoption, have the potential to be a game-changer in the V2L market. Hydrogen-powered FCEVs, such as the Toyota Mirai and Hyundai Nexo, can generate and supply electricity for extended periods, making them ideal for large-scale power applications, including commercial use and disaster relief operations. With increasing investments in hydrogen infrastructure and government incentives for fuel cell technology, FCEVs are projected to grow at a CAGR of 26% in the V2L market. Their long-range and fast refueling advantages over BEVs make them a viable solution for fleet operators and emergency response teams.

Vehicle-to-Load (V2L) Market Revenue Share, By Vehicle Type, 2024 (%)

| Vehicle Type | Revenue Share, 2024 (%) |

| Battery Electric Vehicles (BEVs) | 70% |

| Plug-in Hybrid Electric Vehicles (PHEVs) | 20% |

| Fuel Cell Electric Vehicles (FCEVs) | 10% |

Low Power Output (≤3.6 kW): Low-power V2L solutions are commonly used for charging consumer electronics, powering small household appliances, and providing energy for camping and recreational activities. With a 40% market share in 2024, this segment remains a popular choice among residential users and outdoor enthusiasts. Many automakers are integrating 3.6 kW V2L outlets in their EVs, allowing users to charge smartphones, laptops, and small appliances conveniently. The increasing trend of remote work and digital nomadism is further driving demand for low-power V2L solutions.

Medium Power Output (3.6 – 7 kW): Medium power V2L applications are gaining traction as they can support higher energy demands, such as powering refrigerators, air conditioners, and electric grills. The segment is expected to grow at a CAGR of 28% as more consumers and businesses recognize the benefits of using EVs as portable energy stations. The ability to run essential home appliances during power outages and off-grid situations makes this an attractive option for homeowners and businesses alike. Additionally, improvements in smart energy management systems will enhance the efficiency and usability of medium-power V2L.

High Power Output (≥7 kW): High-power V2L solutions are revolutionizing energy backup systems by enabling EVs to supply electricity to entire households and commercial establishments. This segment, projected to grow at a CAGR of 35%, is particularly beneficial for industries, construction sites, and disaster relief operations that require reliable and continuous power. Automakers such as Ford (with the F-150 Lightning) and Hyundai are introducing V2L systems that can support high-power applications, driving adoption across commercial and industrial sectors. As grid-independent energy solutions gain popularity, high-power V2L will play a critical role in decentralized energy ecosystems.

Consumer Electronics Charging: This segment dominates the V2L market, accounting for over 45% of the total market share in 2024. With an increasing reliance on portable electronic devices, the ability to charge smartphones, laptops, cameras, and even electric scooters using an EV has become a key selling point. As outdoor and travel activities rise, V2L is becoming an essential feature for tech-savvy consumers. EV manufacturers are promoting this feature heavily, positioning their vehicles as mobile power hubs.

Outdoor and Camping: The outdoor and camping segment is growing rapidly, with a projected CAGR of 31% through 2034. V2L-equipped vehicles offer a reliable power source for off-grid adventures, powering camping gear, electric grills, lighting, and even mini-fridges. Brands like Rivian and Tesla have introduced camping modes in their EVs, further enhancing the appeal of V2L for outdoor enthusiasts. With the increasing popularity of sustainable travel and eco-tourism, this segment is expected to see significant growth.

Emergency Backup Power: As extreme weather events and power grid failures become more frequent, consumers and businesses are looking for reliable backup power solutions. The emergency backup power segment is expected to expand at a CAGR of 32%, with more households and businesses integrating V2L with their energy resilience plans. Governments and utility companies are also exploring incentives to promote EVs as backup power sources during grid outages, further driving growth in this segment.

Commercial Use: Businesses, food trucks, mobile offices, and event organizers are leveraging V2L for operational efficiency. With the ability to power tools, audio systems, and equipment without external generators, the commercial segment is gaining traction, projected to hold 20% of the market share by 2034. As mobile businesses continue to expand, the demand for V2L-enabled vehicles is expected to rise significantly.

Residential Users: Residential consumers account for the largest share of the V2L market, representing 50% of total market demand in 2024. Homeowners are increasingly integrating V2L with solar panels and home energy storage systems to create self-sustaining energy solutions. The growing awareness of energy independence and grid resilience is fueling demand, and advancements in smart home energy management will further enhance adoption.

Commercial & Industrial Users: Businesses and industrial users are recognizing the benefits of V2L for reducing energy costs and enhancing operational efficiency. This segment is forecasted to grow at a CAGR of 29%, with applications ranging from remote workstations and construction sites to commercial vehicles acting as mobile power stations. As commercial fleets transition to electric, V2L technology is expected to become a key value-added feature.

Government & Emergency Services: Government agencies and emergency response teams are leveraging V2L for disaster relief, military applications, and infrastructure support. The ability to provide instant power in disaster-stricken areas makes V2L-equipped vehicles a valuable asset for emergency management teams. Governments are also implementing policies that encourage the adoption of bidirectional charging solutions, further strengthening this segment's growth.

The vehicle-to-load market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

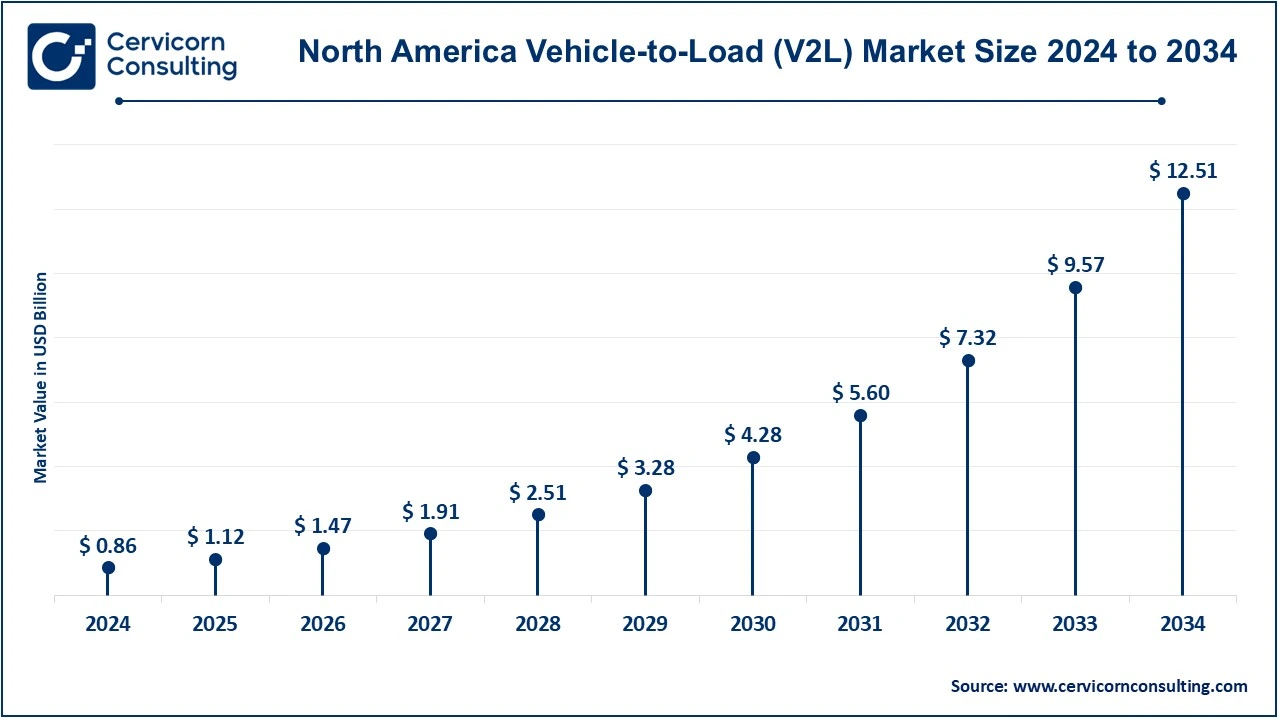

The North America vehicle-to-load (V2L) market size was estimated at USD 0.86 billion in 2024 and is expected to hit around USD 12.51 billion by 2034. North America dominates the V2L market, holding the highest market share in 2024. This leadership is largely driven by the United States, which has a well-established electric vehicle (EV) ecosystem and a rapidly expanding renewable energy sector. The increasing adoption of EVs, supported by government incentives and stringent emission regulations, significantly contributes to the region's dominance in the V2L market. Moreover, advancements in battery technology and energy management systems further enhance the functionality of V2L in North America. The growing demand for off-grid power solutions and disaster resilience, particularly in areas prone to extreme weather events, is driving the adoption of V2L technology as an emergency backup power source. As electric vehicle adoption continues to rise, North America is expected to maintain a strong foothold in the global V2L market.

The Asia-Pacific (APAC) region is anticipated to experience the fastest growth, with a remarkable CAGR. Countries such as China, Japan, and South Korea are at the forefront of EV technology, with strong government support and significant investments in renewable energy integration. The expansion of charging infrastructure, coupled with growing concerns over energy security and sustainability, is accelerating the demand for V2L-capable vehicles. China, the largest EV market globally, is spearheading this growth, with automakers increasingly incorporating V2L functionality in their electric models. Japan, with its advanced energy management systems and disaster preparedness strategies, is also a key contributor to the regional growth. As EV adoption continues to surge, APAC is expected to play a crucial role in shaping the future of the global V2L market.

Europe represents a significant share of the V2L market, driven by its commitment to sustainable energy and electrification of transport. The region has stringent emission reduction policies, extensive EV charging infrastructure, and strong regulatory support for renewable energy integration, making it a key player in the V2L market. Countries such as Germany, France, and the United Kingdom are leading the adoption of V2L technology as part of their broader energy transition strategies. Additionally, the increasing penetration of bidirectional charging solutions and vehicle-grid integration initiatives further strengthens Europe's position in the market. With the EU's ambitious carbon neutrality goals and growing investments in smart grid technologies, the demand for V2L-enabled EVs is expected to remain strong in the coming years.

The LAMEA region is an emerging market for V2L technology, with moderate but steady growth potential. While the market share is currently smaller compared to other regions, countries such as Brazil, Mexico, the UAE, and South Africa are witnessing an increasing adoption of EVs and renewable energy solutions. The rising demand for off-grid and backup power solutions, particularly in remote and rural areas, is driving interest in V2L technology. Government initiatives to promote clean energy, combined with improving EV infrastructure, are expected to support market growth in the region. As awareness of V2L’s benefits increases and more automakers introduce V2L-compatible EVs, LAMEA’s market share is projected to grow steadily over the next decade.

The Vehicle-to-Load (V2L) industry is witnessing intense competition among key automotive manufacturers and energy solution providers aiming to capitalize on the growing demand for bidirectional charging capabilities. Major players such as Nissan, Hyundai, Tesla, and Ford are integrating V2L technology into their electric vehicle (EV) models to enhance their utility and appeal to consumers. These companies are focusing on innovation, strategic partnerships, and expansion of charging infrastructure to drive adoption. Additionally, energy companies like ENGIE and OVO Energy are investing in smart grid solutions to facilitate seamless power transfer from EVs to external devices. The market is further fueled by advancements in battery technology, increasing EV adoption, and government incentives promoting vehicle electrification. As competition intensifies, companies are leveraging technology differentiation, sustainable energy solutions, and user-friendly V2L interfaces to strengthen their market position and gain a competitive edge.

Market Segmentation

By Vehicle Type

By Power Output

By Application

By End-User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Vehicle-to-Load (V2L)

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Vehicle Type Overview

2.2.2 By Power Output Overview

2.2.3 By Application Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Adoption of Electric Vehicles (EVs)

4.1.1.2 Demand for Portable and Emergency Power Solutions

4.1.2 Market Restraints

4.1.2.1 Infrastructure Challenges

4.1.2.2 Regulatory Barriers

4.1.3 Market Challenges

4.1.3.1 Technical Challenges

4.1.3.2 Consumer Awareness and Acceptance

4.1.4 Market Opportunities

4.1.4.1 Integration with Renewable Energy Sources

4.1.4.2 Development of New Business Models

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Vehicle-to-Load (V2L) Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Vehicle-to-Load (V2L) Market, By Vehicle Type

6.1 Global Vehicle-to-Load (V2L) Market Snapshot, By Vehicle Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Battery Electric Vehicles (BEVs)

6.1.1.2 Plug-in Hybrid Electric Vehicles (PHEVs)

6.1.1.3 Fuel Cell Electric Vehicles (FCEVs)

Chapter 7. Vehicle-to-Load (V2L) Market, By Power Output

7.1 Global Vehicle-to-Load (V2L) Market Snapshot, By Power Output

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Low Power Output (≤3.6 kW)

7.1.1.2 Medium Power Output (3.6 – 7 kW)

7.1.1.3 High Power Output (≥7 kW)

Chapter 8. Vehicle-to-Load (V2L) Market, By Application

8.1 Global Vehicle-to-Load (V2L) Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Consumer Electronics Charging

8.1.1.2 Outdoor and Camping

8.1.1.3 Emergency Backup Power

8.1.1.4 Commercial Use

Chapter 9. Vehicle-to-Load (V2L) Market, By End-User

9.1 Global Vehicle-to-Load (V2L) Market Snapshot, By End-User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Residential Users

9.1.1.2 Commercial & Industrial Users

9.1.1.3 Government & Emergency Services

Chapter 10. Vehicle-to-Load (V2L) Market, By Region

10.1 Overview

10.2 Vehicle-to-Load (V2L) Market Revenue Share, By Region 2024 (%)

10.3 Global Vehicle-to-Load (V2L) Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Vehicle-to-Load (V2L) Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Vehicle-to-Load (V2L) Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Vehicle-to-Load (V2L) Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Vehicle-to-Load (V2L) Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Vehicle-to-Load (V2L) Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Vehicle-to-Load (V2L) Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Vehicle-to-Load (V2L) Market, By Country

10.5.4 UK

10.5.4.1 UK Vehicle-to-Load (V2L) Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Vehicle-to-Load (V2L) Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Vehicle-to-Load (V2L) Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Vehicle-to-Load (V2L) Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Vehicle-to-Load (V2L) Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Vehicle-to-Load (V2L) Market, By Country

10.6.4 China

10.6.4.1 China Vehicle-to-Load (V2L) Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Vehicle-to-Load (V2L) Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Vehicle-to-Load (V2L) Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Vehicle-to-Load (V2L) Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Vehicle-to-Load (V2L) Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Vehicle-to-Load (V2L) Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Vehicle-to-Load (V2L) Market, By Country

10.7.4 GCC

10.7.4.1 GCC Vehicle-to-Load (V2L) Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Vehicle-to-Load (V2L) Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Vehicle-to-Load (V2L) Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Vehicle-to-Load (V2L) Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Nissan Motor Corporation

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Mitsubishi Motors Corporation

12.3 Groupe Renault

12.4 ENGIE Group

12.5 OVO Energy Ltd.

12.6 Honda Motor Co., Ltd.

12.7 Hyundai Motor Company

12.8 Tesla, Inc.

12.9 Ford Motor Company

12.10 General Motors

12.11 Kia Corporation

12.12 SUN Mobility