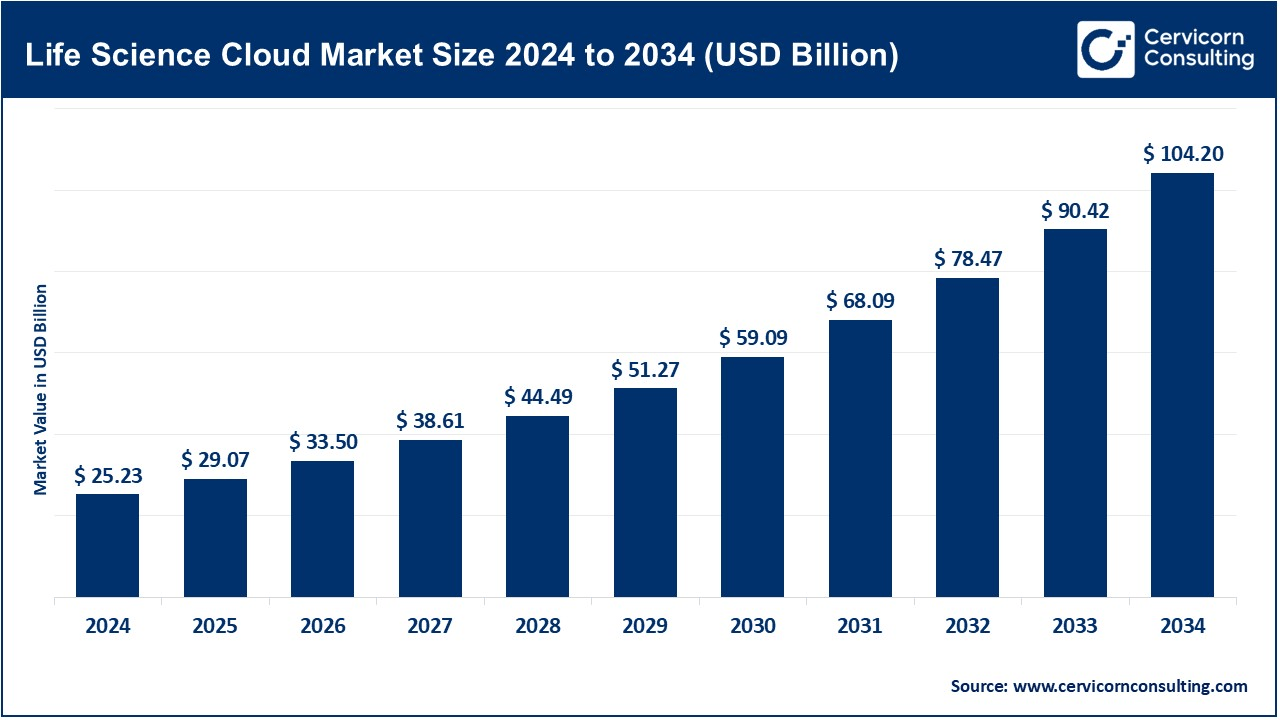

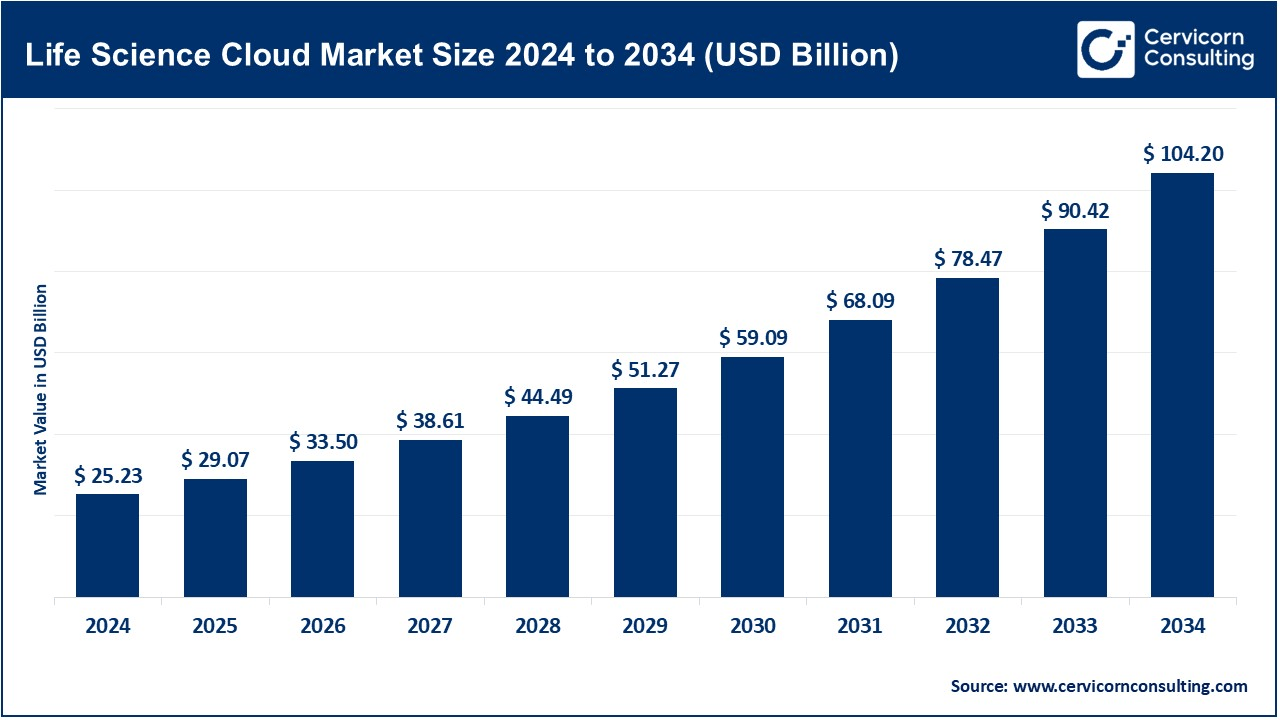

Life Science Cloud Market Size and Growth 2025 to 2034

The global life science cloud market size was valued at USD 25.23 billion in 2024 and is expected to reach around USD 104.20 billion by 2034, growing at a compound annual growth rate (CAGR) of 15.23% over the forecast period from 2025 to 2034.

The life science cloud market is growing rapidly thereby reforming approaches in conducting research, managing data, and collaboration among life sciences entities. The life science cloud market is driven by an increasing volume of data, the need for scalable, cost-effective solutions, growing global collaboration, increased emphasis on AI/ML and big data analytics, and advanced R&D. With improved regulatory compliance, global collaboration, and development of patient-centric models, these are further accelerating the rapid growth of cloud services in the lifecycle of life science.

The term "life science cloud market" describes the use of cloud computing and associated technologies in the life science sector, which includes the biotechnology, pharmaceutical, diagnostic, medical device, and healthcare sectors. These cloud-based systems enable the management, analysis, and storage of large amounts of data generated during research, drug development, clinical trials, patient treatment, and adherence to regulations. The life science cloud market has seen substantial growth due to the increasing dependence on digital technologies, the demand for scalable infrastructure, and the rising volume of data produced in the life science sector. Cloud services empower organizations to improve collaboration, reduce operational costs, and accelerate product development.

The escalating demand for data management, cost efficiency, collaboration, and scalability within the life science sector is propelling the swift expansion of the life science cloud market. By integrating AI, machine learning, and other advanced technologies, the cloud facilitates companies in expediting drug research, enhancing clinical trials, improving patient care, and ensuring regulatory compliance. As more health sciences organisations use cloud solutions to handle the problems of the digital age, the market is expected to evolve.

Life Science Cloud Market Growth Factors

- Growing Scalability and Flexibility: Cloud computing offers an unprecedented level of scalability and flexibility for life sciences healthcare management. As storage, processing power and data analytics demands continue to grow, cloud platforms can be effortlessly scaled up or down so healthcare organizations have the resources they need when they need them. The cloud solves the problem of needing large infrastructure by providing secure and affordable storage.

- Data Storage and Access: The cloud solves problems that require large infrastructure by providing secure and affordable storage. Additionally, cloud-based platforms allow data to be accessed from anywhere, facilitating collaboration among researchers, clinicians, and healthcare administrators. Accessibility means important information is always available, enabling better decision making.

- Resource Optimisation and Cost-effectiveness: The growth of healthcare organizations could be limited by legacy IT systems, particularly in the resource-intensive life sciences sector. Companies can opt for cloud computing, which is a cost-effective choice that eliminates the need for large initial investments. This pay-per-use approach encourages efficient use of resources and enables healthcare administrators to allocate funds effectively, allowing them to focus on delivering superior patient care and advancing new medical technologies.

- Recovery from Disasters and Uninterrupted Operations: Healthcare organizations that cannot afford these services could benefit from better disaster recovery and business continuity capabilities rather than cloud computing. Cloud platforms' automatic backup solutions ensure that important data is stored in many geographically dispersed locations. In the event of a disaster or system failure, healthcare administration can quickly resume operations, ensuring the continuation of patient care and research projects.

Life Science Cloud Market Trends

- Enhanced Security and Compliance: Security and compliance are of paramount importance in healthcare, as sensitive patient data and research results must be protected. Cloud service providers invest heavily in robust security measures, including encryption, access controls and regular audits, to ensure data is protected from unauthorized access. Additionally, cloud platforms often adhere to industry-specific compliance standards, such as HIPAA in the US, so healthcare management can be confident that their data is being handled in accordance with legal requirements.

- Advanced Data Analytics and Machine Learning: Cloud computing’s ability to process and analyze massive data sets in real-time is a game changer for healthcare management in the life sciences. Advanced data analytics and machine learning algorithms can uncover patterns, identify trends, and derive meaningful insights from complex healthcare data. This capability is critical to improving diagnostics, predicting disease outbreaks, and personalizing treatment plans, ultimately improving patient outcomes.

- Innovations in Gut Health Monitoring Technology: New technologies are revolutionizing the monitoring of the health of the gut. Innovative tools and tests now provide personalized information, enabling people to better manage digestive health based on specific problems. As access to health care continues to improve, these advances are increasingly recognized as essential for personal health care.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 29.07 Billion |

| Expected Market Size in 2034 |

USD 104.20 Billion |

| Poojected CAGR 2025 to 2034 |

15.23% |

| Dominant Region |

North America |

| Fastet Growing Region |

Asia-Pacific |

| Key Segments |

Service Model, Deployment Mode, Application, End-User and Region |

| Key Companies |

Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM Cloud, Oracle Cloud, Salesforce, Accenture, Veeva Systems, SAP, Cerner, Medtronic, Siemens Healthineers, IQVIA, Fujitsu, GE Healthcare, Labcorp Drug Development, Wipro, Atos, DXC Technology, Biocrates Life Sciences, Illumina, Mendel.ai |

Life Science Cloud Market Dynamics

Market Drivers

Increasing Adoption of Digital Transformation in Life Sciences

- The life sciences industry generates large amounts of data such as patient records, clinical trial results, genomic data and research findings. Cloud platforms provide scalable and efficient solutions to store, process and analyze this data, leading to improved operational efficiency and faster decision making. Cloud technologies are increasingly being used to support clinical trials by optimizing data collection and collaboration between global research teams and enabling real-time access to clinical trial data.

Improved Collaboration and Remote Work Opportunities

- Life sciences research and development often requires collaboration between global teams of scientists, physicians and engineers. Cloud platforms support real-time teamwork and data sharing. This allows teams to collaborate from various locations without costly on-site equipment. Cloud solutions help healthcare providers, researchers, and pharmaceutical companies to monitor patients remotely, conduct virtual trials, and share information securely. The post-pandemic atmosphere of today makes this capacity even more important.

Market Restraints

Data Security and Privacy Concerns

- Life sciences companies manage sensitive information, including patient health data, clinical trial outcomes, and intellectual property. Data leaks and cyberattacks on cloud platforms pose significant risks. If data is compromised, it can result in regulatory violations, reputational harm, and legal troubles. Laws like HIPAA, GDPR, and other national data protection regulations necessitate strict data security measures. For life sciences companies, meeting these complex requirements can be difficult, especially when relying on third-party cloud services across different regions.

Complicated Regulation and Compliance

- The life sciences sector is subject to strict regulations when it comes to drug research, clinical trials and patient data management. The need to adapt to new rules can be challenging and costly for cloud service providers. The shifting nature of cloud policies presents hurdles that businesses must navigate if they intend to harness the power of the cloud effectively. Life sciences companies, especially in biotechnology and pharmaceuticals, need to check their cloud systems for compliance with regulations like FDA 21 CFR Part 11, which governs electronic records and signatures. This validation procedure might take a long time and require significant resources, increasing implementation costs.

Market Opportunities

Scientific Progress in Big Data Analytics and Artificial Intelligence (AI)

- Cloud platforms provide powerful computing capabilities that enable the integration of artificial intelligence and machine learning tools to process large data sets in life sciences. These technologies help in drug discovery, genomics, predictive analytics, and personalized medicine. The ability to analyze data in real time is a major benefit of cloud platforms. AI-driven analytics help researchers and clinicians make more informed decisions faster, improving outcomes in drug development and patient care.

Development in Genomics and Personalised Medicine

- Personalized medicine and genomics are increasingly playing a crucial role in patient care. Cloud solutions offer the necessary storage and computing power to analyze large amounts of genomic data. These services lead to advancements in creating personalized treatment plans and specialized therapies. Many life sciences and healthcare companies are using dedicated genomic cloud platforms to store and assess patient genomic data. This enhances the accuracy of diagnoses and treatments.

Market Challenges

Integration with Existing Legacy Systems

- Many life sciences companies still rely on legacy systems for data storage, management and analysis. Integrating these legacy systems into modern cloud-based solutions can be complex and time-consuming. Legacy systems may not fully utilize cloud capabilities, necessitating additional investment in custom integrations or system upgrades. The transition to cloud-based solutions can disrupt established workflows at life sciences companies. Employees may need to be retrained and new procedures implemented, which can slow things down during the transition.

Insufficient Standardization

- The life sciences industry is experiencing a lack of standardization in cloud solutions. Different cloud providers offer different levels of service, security and features, and these platforms may not always be able to interoperate with each other. This lack of standardization can make choosing the right platform difficult and complicate data sharing across different organizations or stakeholders. Different regions and countries define cloud solutions for life sciences in various ways. This inconsistency can complicate the efforts of companies aiming to implement global cloud strategies, particularly when they operate across markets with unique regulatory demands.

Life Science Cloud Market Segmental Analysis

Service Model Analysis

Software as a Service (SaaS): SaaS technologies are utilized in various life sciences applications such as clinical trial administration, data analytics, regulatory compliance, and patient data management. SaaS companies provide software programs as needed by hosting them in the cloud.

Platform as a Service (PaaS): PaaS provides platforms for building, deploying, and managing custom life sciences applications. This includes R&D, clinical trials, and regulatory compliance applications that require customized configurations.

Infrastructure as a Service (IaaS): IaaS solutions provide life sciences companies with virtualized computing resources such as storage, networking, and computing power to support large data sets and cloud applications.

Deployment Mode Analysis

Public: A public cloud is a shared environment in which cloud service providers provide computing resources and services to multiple organizations. The cost-effective and scalable solution may raise concerns regarding data privacy and security.

Private: A private cloud is a dedicated infrastructure used by an organization, providing greater control, privacy and security. Private clouds are often preferred by life sciences companies dealing with sensitive patient data or proprietary research.

Hybrid: Hybrid clouds combine elements of public and private clouds, allowing life sciences companies to host sensitive data in private clouds, and leverage the public cloud for scalable resources and non-sensitive data storage.

Application Analysis

Investigation and Innovation: Life science companies utilize cloud services to process and analyze the large and intricate data sets produced during research activities like clinical studies, drug design, and genomics.

Clinical Trials: Technologies for managing clinicals from the cloud cover the trial patient information, the trial development and the compliance with the regulations.

Patient Data Management: Cloud solutions help life sciences companies and healthcare providers safely manage, store, and exchange patient data while following to regulations such as GDPR and HIPAA.

Regulatory Compliance and Reporting: Cloud-based solutions assist health sciences organisations in complying with industry regulations (for example, FDA, EMA) by automating regulatory reporting and ensuring data protection standards are met.

Supply chain supervision: Cloud technologies help pharmaceutical companies improve supplier management with demand forecasting, equipment supply, and inventory management services.

Collaboration and Data exchange: Life sciences groups use cloud technology for fast teamwork among researchers, doctors, regulators, and health science stakeholders.

Commercial Operations: Cloud solutions help manage sales, marketing, and distribution of life sciences products, including pharmaceuticals, medical devices, and diagnostics.

End-User Analysis

Pharmaceutical and Biotechnology Companies: These organizations are the largest consumers of life science cloud services and use them for drug development, regulatory compliance, clinical trials, and research.

Hospitals and medical facilities: Healthcare organizations use cloud technologies to manage electronic health records (EHR), improve patient care, and increase operational efficiency.

Medical Device Manufacturers: Medical device production, product development, and compliance management are all done with cloud technologies.

Contract Research Organizations (CROs): CROs provide outsourced clinical trial services and use cloud platforms for data management, analysis and regulatory reporting.

Academic and Research Institutes: Research institutions leverage cloud services for large-scale data storage, data analytics, and collaboration with pharmaceutical and biotech companies.

Regulatory agencies: Supervision authorities use cloud solutions to manage compliance, continue clinical studies and store sensitive health data.

Life Science Cloud Market Regional Analysis

The life science cloud market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

North America Life Science Cloud Market Trends

- The growth of cloud technologies in the life science industry is mostly dependent on North America's life science cloud market, which is driven by significant investment in R&D, a strong healthcare system, and technical advancements. North America, particularly the United States, occupies a leading position in the global life science cloud market due to its strong healthcare and life science industry, governmental initiatives and funding, as well as regulatory support and cloud compliance.

- Life science organizations in North America are using cloud platforms to reduce costs for data storage and IT. Cloud computing offers scalability, allowing organizations to increase or decrease their infrastructure in line with their changing requirements, making it an attractive choice for both large pharmaceutical companies and smaller biotech startups. The life sciences sector increasingly uses cloud solutions to meet the rising demand for platforms that manage clinical trials and simplify data sharing. These platforms enhance clinical data collection, allow real-time monitoring, and facilitate data review, which all lead to more effective trials.

Europe Life Science Cloud Market Trends

- Europe is a key player in the global life science cloud market, fueled by rising investments in healthcare data, clinical trials, personalized medicine, and research and development. The EU supports digital health and cloud technology adoption through policies and funding. For instance, the Digital Single Market Strategy and Horizon Europe aim to stimulate digital health innovation and promote cloud usage in the life sciences domain. Within Europe, there is a heightened emphasis on precision medicine and genomics research, fueled by progress in molecular biology, genetics, and biotechnology.

- Cloud technologies are essential for managing extensive genomic datasets, promoting collaborations, and facilitating data analytics to enhance personalized medicine. Although challenges persist regarding data security, regulatory adherence, and the integration of legacy systems, the market benefits from robust government initiatives, sophisticated healthcare infrastructure, and increasing demand for digital health and precision medicine offerings. With the integration of AI, big data, and genomics, Europe is expected to be a significant player in the global life sciences cloud market.

Asia-Pacific Life Science Cloud Market Trends

- The life sciences cloud market in the Asia Pacific (APAC) region is experiencing substantial expansion, fueled by a blend of swift technological developments, rising digitization of health services, and an increasing emphasis on research and development within life sciences. The APAC region is diverse, with countries at different stages of development in terms of healthcare infrastructure, technology adoption, and regulatory frameworks.

- Governments across the APAC region are promoting digital health and cloud adoption in the life sciences sector. In China, for example, the government has highlighted technological advancements in healthcare with its “Made in China 2025” initiative, which includes digital health and biotechnology. India initiated the National Digital Health Mission (NDHM) to promote telemedicine and electronic health records.

- Cloud platforms are increasingly significant in healthcare due to an emphasis on data protection. This is particularly relevant with emerging regulations akin to GDPR in various nations. The life sciences sector in Asia is teeming with businesses looking to save infrastructure and operating expenses. Cloud computing has the benefit of allowing for resource expansion and adjustment as needed, which is particularly beneficial for small to medium-sized pharmaceutical firms, research organisations, and healthcare institutions in the industry. For research institutes and biotech start-ups in countries such as Singapore, South Korea and India, the opportunity to expand cloud infrastructure without significant upfront investment is particularly tempting, as their financial resources may be less than those of large, established pharmaceutical companies.

LAMEA Life Science Cloud Market Trends

- The increasing need for digital transformation in healthcare, research, and pharmaceutical development is driving the life science cloud market in LAMEA to become a key area for cloud adoption in the life science industry. Although less developed than other regions, LAMEA has significant potential for growth, particularly in view of healthcare reforms, technological advancements, and growing healthcare demands. The life science cloud market in the region is experiencing growth as a result of various factors, including an increase in investments directed towards healthcare infrastructure, the adoption of digital healthcare solutions, and an amplified emphasis on personalized medicine.

- Investments in healthcare infrastructure are being undertaken throughout Latin America, particularly in nations such as Argentina, Brazil, and Mexico. Middle Eastern nations like Saudi Arabia, Qatar, and the United Arab Emirates (UAE) have made healthcare investments a top priority as part of their larger plans for economic diversification. In a similar context, Africa is striving to improve its healthcare systems and is focusing more on modernizing healthcare data management. Many life science organizations in LAMEA are looking to collaborate with global players, especially in the areas of research and clinical trials. Cloud solutions enable cross-border collaboration by providing secure, real-time data sharing capabilities.

- The growing need for multinational clinical trials in drug development and research is driving the demand for cloud platforms that facilitate data sharing and collaboration between researchers from different countries. Africa is a growing hub for clinical trials, especially in the areas of infectious diseases such as HIV and malaria, and cloud-based platforms help manage the data generated from these trials.

Life Science Cloud Market Top Companies

Recent Developments

- In October 2024, the collaborative relationship between Honeywell and Salesforce has been expanded to offer a full suite of software solutions for the health sciences sector. With Salesforce Life Sciences Cloud, Agentforce, Honeywell's TrackWise Quality and other products, the platform helps pharmaceutical and medical device companies get critical medicines and medical devices to patients faster, more efficiently and more effectively.

- In September 2024, Infinitus Systems announced a strategic partnership with Salesforce that will enable the Infinitus AI Agent to be activated directly from the Life Sciences Cloud. With the partnership, Life Sciences Cloud users can use the AI Agent to call payers and Pharmacy Benefit Managers (PBMs) to verify insurance benefits, go through prior authorizations and check the status of drug list exceptions and appeals to get life-enhancing treatments into patients' hands faster.

- In October 2023, Salesforce announced Life Sciences Cloud, a trusted, secure platform for pharmaceutical and medical device companies to help them accelerate drug and device development, acquire and retain patients throughout the clinical trial phase, and use AI to deliver personalized experiences to customers.

Market Segmentation

By Service Model

- Software as a Service (SaaS)

- Platform as a Service (PaaS)

- Infrastructure as a Service (IaaS)

By Deployment Mode

By Application

- Research and Development (R&D)

- Clinical Trials

- Patient Data Management

- Regulatory Compliance and Reporting

- Supply Chain Management

- Collaboration and Data Sharing

- Commercial Operations

By End-User

- Pharmaceutical and Biotechnology Companies

- Hospitals and Healthcare Providers

- Medical Device Manufacturers

- Contract Research Organizations (CROs)

- Academic and Research Institutes

- Regulatory Authorities

By Region

- North America

- Europe

- APAC

- LAMEA

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Life Science Cloud

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Service Model Overview

2.2.2 By Deployment Mode Overview

2.2.3 By Application Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Adoption of Digital Transformation in Life Sciences

4.1.1.2 Improved Collaboration and Remote Work Opportunities

4.1.2 Market Restraint

4.1.2.1 Data Security and Privacy Concerns

4.1.2.2 Complicated Regulation and Compliance

4.1.3 Market Challenges

4.1.3.1 Integration with Existing Legacy Systems

4.1.3.2 Insufficient Standardization

4.1.4 Market Opportunity

4.1.4.1 Scientific Progress in Big Data Analytics and Artificial Intelligence

4.1.4.2 Development in Genomics and Personalised Medicine

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Life Science Cloud Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Life Science Cloud Market, By Service Model

6.1 Global Life Science Cloud Market Snapshot, By Service Model

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Software as a Service (SaaS)

6.1.1.2 Platform as a Service (PaaS)

6.1.1.3 Infrastructure as a Service (IaaS)

Chapter 7. Life Science Cloud Market, By Deployment Mode

7.1 Global Life Science Cloud Market Snapshot, By Deployment Mode

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Public

7.1.1.2 Private

7.1.1.3 Hybrid

Chapter 8. Life Science Cloud Market, By Application

8.1 Global Life Science Cloud Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Research and Development (R&D)

8.1.1.2 Clinical Trials

8.1.1.3 Patient Data Management

8.1.1.4 Regulatory Compliance and Reporting

8.1.1.5 Supply Chain Management

8.1.1.6 Collaboration and Data Sharing

8.1.1.7 Commercial Operations

Chapter 9. Life Science Cloud Market, By End-User

9.1 Global Life Science Cloud Market Snapshot, By End-User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Pharmaceutical and Biotechnology Companies

9.1.1.2 Hospitals and Healthcare Providers

9.1.1.3 Medical Device Manufacturers

9.1.1.4 Contract Research Organizations (CROs)

9.1.1.5 Academic and Research Institutes

9.1.1.6 Regulatory Authorities

Chapter 10. Life Science Cloud Market, By Region

10.1 Overview

10.2 Life Science Cloud Market Revenue Share, By Region 2024 (%)

10.3 Global Life Science Cloud Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Life Science Cloud Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Life Science Cloud Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Life Science Cloud Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Life Science Cloud Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Life Science Cloud Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Life Science Cloud Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Life Science Cloud Market, By Country

10.5.4 UK

10.5.4.1 UK Life Science Cloud Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Life Science Cloud Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Life Science Cloud Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Life Science Cloud Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Life Science Cloud Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Life Science Cloud Market, By Country

10.6.4 China

10.6.4.1 China Life Science Cloud Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Life Science Cloud Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Life Science Cloud Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Life Science Cloud Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Life Science Cloud Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Life Science Cloud Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Life Science Cloud Market, By Country

10.7.4 GCC

10.7.4.1 GCC Life Science Cloud Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Life Science Cloud Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Life Science Cloud Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Life Science Cloud Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Amazon Web Services

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Microsoft Azure

12.3 Google Cloud

12.4 IBM Cloud

12.5 Oracle Cloud

12.6 Salesforce

12.7 Accenture

12.8 Veeva Systems

12.9 SAP

12.10 Cerner

12.11 Medtronic

12.12 Siemens Healthineers

12.13 IQVIA

12.14 Fujitsu

12.15 GE Healthcare

12.16 Labcorp Drug Development

12.17 Wipro

12.18 Atos

12.19 DXC Technology

12.20 Biocrates Life Sciences

12.21 Illumina

12.22 Mendel.ai

...