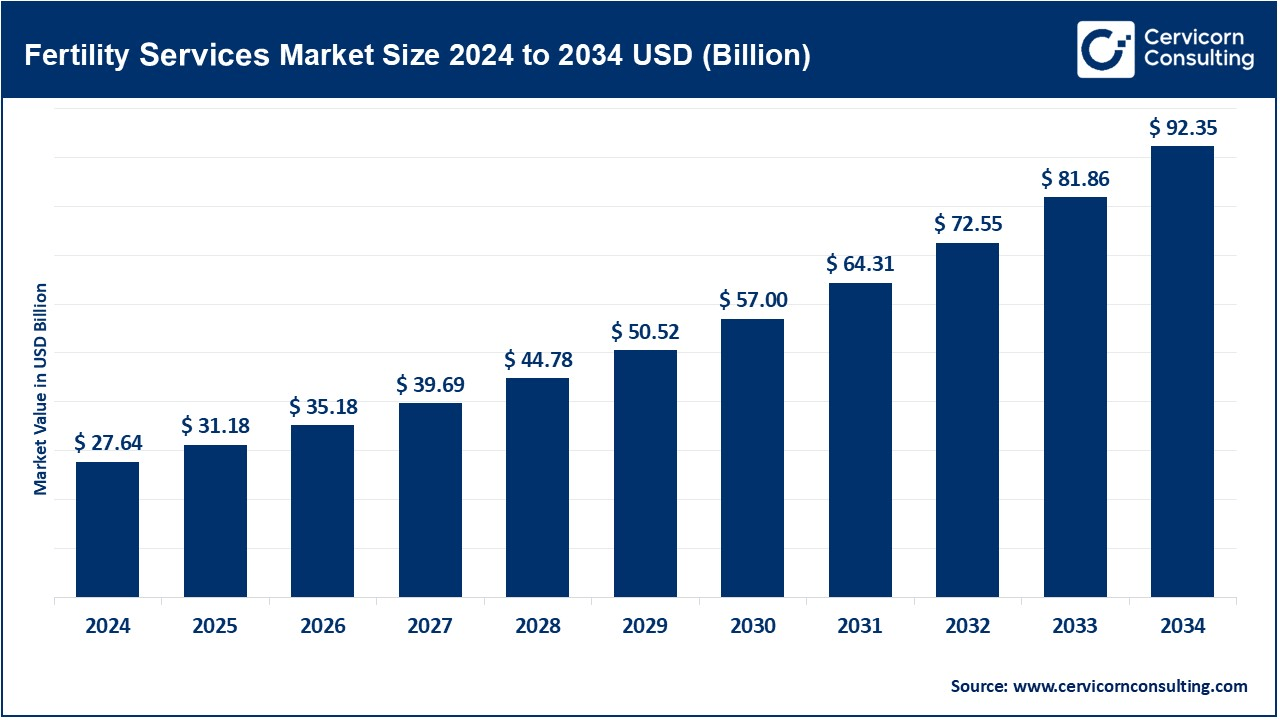

The global fertility services market size was valued at USD 27.64 billion in 2024 and is estimated to reach around USD 92.35 billion by 2034, growing at a compound annual growth rate (CAGR) of 12.82% during the forecast period from 2025 to 2034. The fertility services market is experiencing robust growth driven by factors such as increasing infertility rates due to changing lifestyles, delayed pregnancies, and rising prevalence of reproductive health disorders. Additionally, advancements in assisted reproductive technologies (ART), growing awareness about fertility treatments, supportive government initiatives, and the increasing number of fertility clinics globally are fueling market expansion. Moreover, shifting societal norms, greater acceptance of fertility preservation, and innovations in genetic testing further contribute to the robust growth of this market.

Fertility services represent a broad range of medical interventions, procedures, and support directed at diagnosing and treating conditions of infertility so that the person or couple might conceive. Advanced fertility techniques include IVF, intrauterine insemination, egg and sperm freezing for fertility preservation, and donor programs. Fertility services also include diagnostic assessments accompanied by hormonal treatments and surgical treatments in the treatment of the underlying conditions that have an impact on reproductive health. As ART techniques continue to evolve, these services are becoming more tailored and offering hope to those who have problems conceiving. Improving knowledge and social acceptance is making fertility services more accessible and effective worldwide, and technological advancements ensure that the journey is easier.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 31.18 Billion |

| Expected Market Size in 2034 | USD 92.35 Billion |

| Projected Market CAGR | 12.82% |

| Premier Region | Europe |

| Highest Growth Region | Asia-Pacific |

| Key Segments | Type, Procedure, Services, End-User, Region |

| Key Companies | Olympus Corporation, The Cooper Companies Inc., Instituto Bernabeu, VirtusHealth, CooperSurgical, Inc., Vitrolife, Care Fertility, INVO Bioscience, Monash IVF, Fertility Focus Limited, Carolinas Fertility Institute, Apollo Hospitals Enterprise Ltd., Merck KGaA, LABOTECT GMBH, Medicover AB |

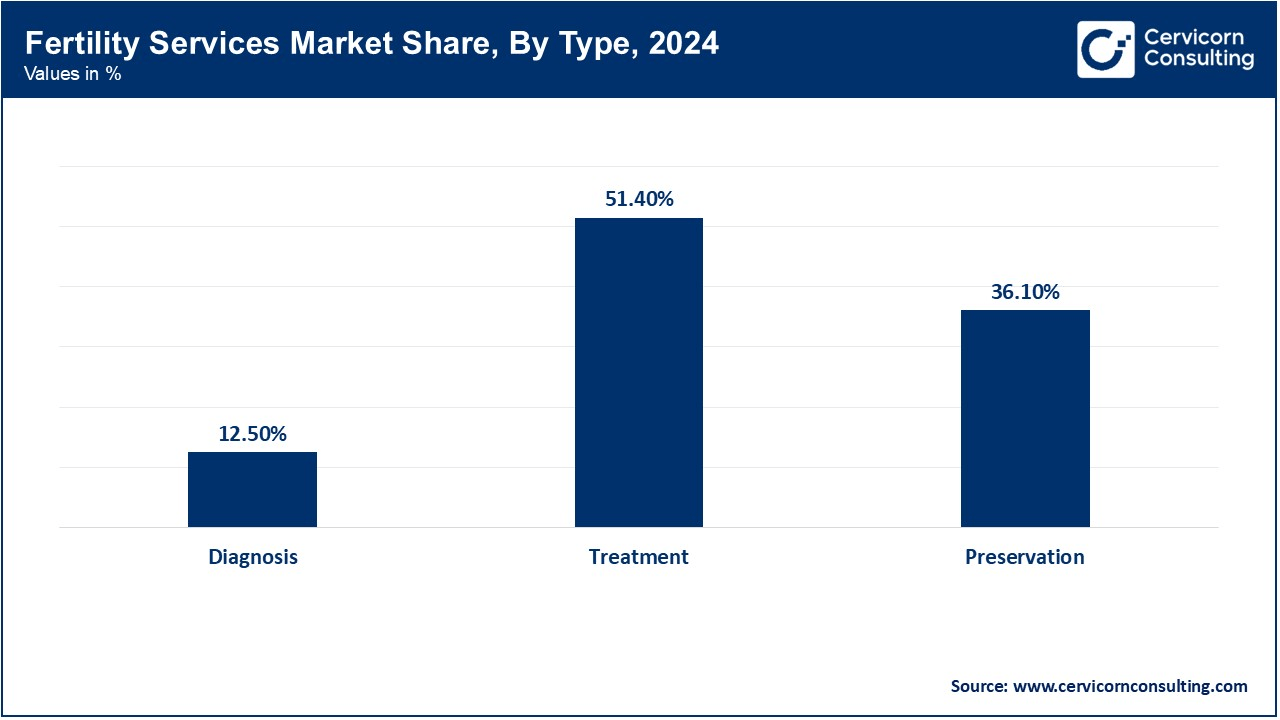

The fertility services market is segmented into type, procedure, services, end-user and region. Based on type, the market is classified into diagnosis, treatment and preservation. Based on procedure, the market is classified into assisted reproductive technology (ART), in-vitro fertilization (IVF), artificial insemination, surrogacy and others. Based on services, the market is classified into donor services and non-donor services. Based on end user, the market is classified into fertility clinics, hospitals, clinical research institutes and surgical centers.

Based on type, the treatment segment accounted for a highest revenue share in 2024. The treatment segment is classified into In-vitro fertilization (IVF) and artificial insemination.

The preservation segment is projected to grow at a lucrative CAGR over the forecast period. The preservation segment is classified into egg & embryo freezing and sperm banking.

ART: ART comprises all those medical interventions aimed at assisting an individual or a couple in the reproductive process. In ART, egg and sperm management is conducted as treatments for infertility through procedures like IVF, artificial insemination, and surrogacy. Through many inventions of modern ART techniques, its effectiveness has greatly increased to achieve a desired level of fertility outcome. Thus, most fertility treatments focus on different cases of infertility with male or female factors, for which it serves a fundamental part in managing such infertility conditions.

In-vitro fertilization (IVF): This is one of the most successful and sought-after ART treatments for reproductive support. IVF includes fertilizing the egg outside the human body and then transplanting the embryo into the uterus. IVF has a high success rate but is costly and often requires more than one cycle, usually following other methods such as genetic testing. It can be used to treat many causes of infertility, including tubal obstruction, male factor, and even an older woman's declining fertility with age.

Artificial Insemination: This is a technique whereby sperms are directly introduced into the woman's reproductive system, avoiding the natural barriers to conception. It is used mainly when male infertility exists or in cases where sperm donation insemination is to be used, or other forms of ARTs are not needed. It is less invasive and cheaper than IVF but its success rate is lower. The procedure may be performed either with or without the administration of medications that stimulate ovulation, based on the condition of the patient.

Surrogacy: This is a method in which a woman carries a pregnancy for someone or a couple unable to conceive or carry a pregnancy. There are two kinds: traditional surrogacy, which involves using a surrogate's own eggs, and gestational surrogacy, whose eggs may originate from the intending mother or even a donor. Surrogacy is a complex subject because it involves legal, medical, and emotional aspects and is broadly applied when women cannot carry a pregnancy due to health issues.

Others: Other fertility services include the following: treatments such as freezing of eggs, freezing of sperms, freezing of embryos, and genetic screening. Such services allow one to keep reproductive material to be used later. This gives much freedom to individuals who may desire to delay getting a family or who may be faced with infertility later in life.

Donor Services: This is a service offering eggs, sperm, or embryos to people or couples who are not able to produce viable reproductive cells because of infertility issues or genetic disorders. Donor services are used in ART, particularly in IVF, to facilitate conception. Many fertility centers provide anonymous or known donor services and, in some cases, even offer genetic screening for the health of the gametes of the donor. Demand for donor services is surging among single-parent or same-sex couples thus propelling the market.

Non-donor Services: Such services are services where the reproductive material of a patient or a couple is applied to treat the issue of fertility. This type of service pertains to ART methods such as IVF and AI in which a third-party contribution is not essential to treat infertility. Patients who can see biological offspring but are failing to do so because of age or hormonal imbalances, or issues of male factor infertility, have an inclination towards these non-donor services.

Fertility Clinics: They are specialized health centers that offer fertility services, among them, ART, IVF, among others. These tend to be the first places most people or their couples come for fertility care because they are usually more individualized. Fertility clinics are very advanced, having all the high-tech equipment like: sperm and egg retrieval laboratories and embryo culture. The number of fertility clinics is mushrooming globally, thus increasing the accessibility of services to a greater population of patients because of increasing demand for fertility services.

Hospitals: Many hospitals also offer fertility treatments, especially in larger specialized departments. The medical equipment here is more developed, and the staff are better trained. This is a more popular option among patients with more serious medical conditions, such as those who have cancer and want to preserve their fertility or women with various health problems. They might partner with fertility clinics to provide ART services within an integrated approach to healthcare.

Clinical Research Institutes: Clinical research institutes are crucial for furthering fertility treatments based on research and clinical trials. They focus mainly on developing new fertility technologies, improving treatment success rates for treatments like IVF, and improving techniques regarding genetic screening. They are usually in alliance with pharmaceutical companies and universities to develop new drugs, procedures, and techniques. Research centers give the impetus to expand fertility treatments, including stem cell research, genetic testing, and fertility plans tailored to the individual.

Surgical Centers: These are specialized medical centers conducting outpatient surgical procedures, such as issues concerned with fertility.These centers can include the retrieving of eggs, sperm retrieval, or surgery for endometriosis or other conditions, such as blocked fallopian tubes, which may impair one's ability to conceive. Even many surgeries are used through surgical centers on more minor occasions that also might not cause lengthy recovery sessions afterward. Also, surgical fertility facilities are dedicated locations for patient operations that aim directly at producing surgically assisted infusions.

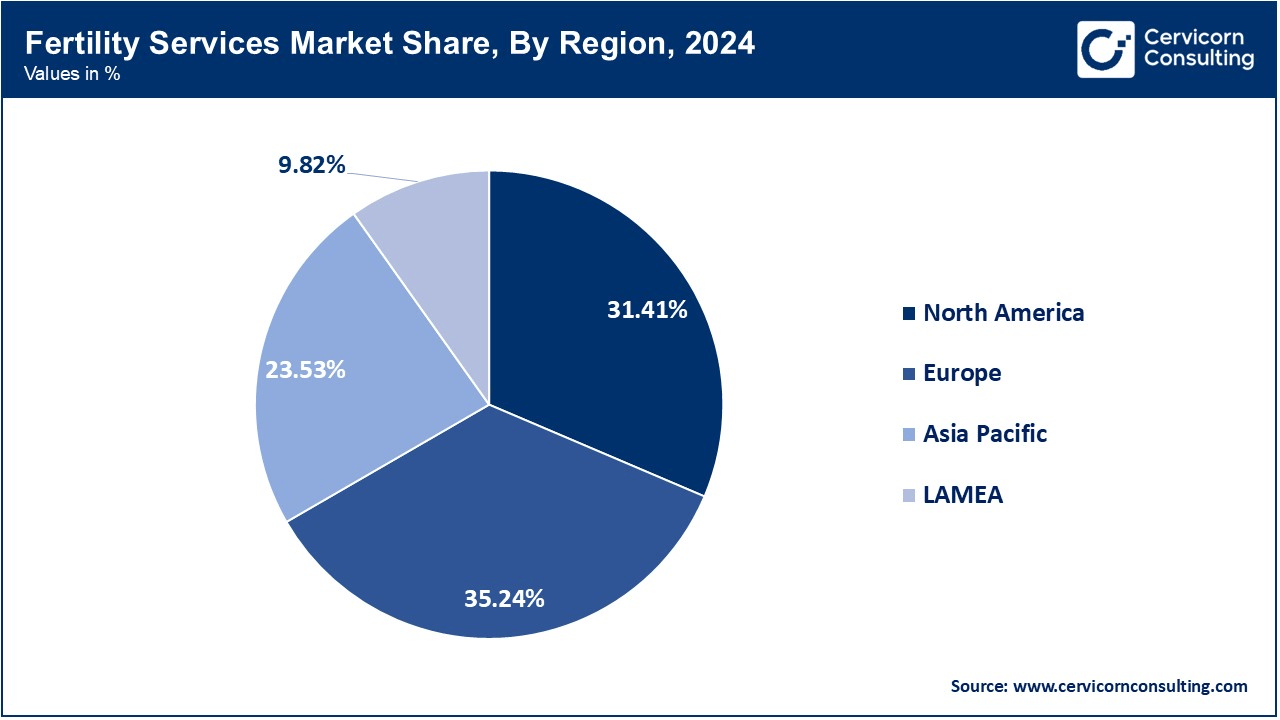

The fertility services market can be segmented into the following key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Each of these regions is described in further detail as follows.

The region is characterized by superior healthcare infrastructure, high awareness of infertility treatments, and higher disposable income. The well-established fertility clinics, new and advanced technologies of reproductive assisted like IVF, and high adoption of donation services of both eggs and sperms are contributing growth factors to this market. Along with these drivers, the favorably regulatory setting of North America and government backing for ART technology further supports its expansion. With women increasingly delaying pregnancies for career or other lifestyle reasons, there is increasing demand for preservation of fertility.

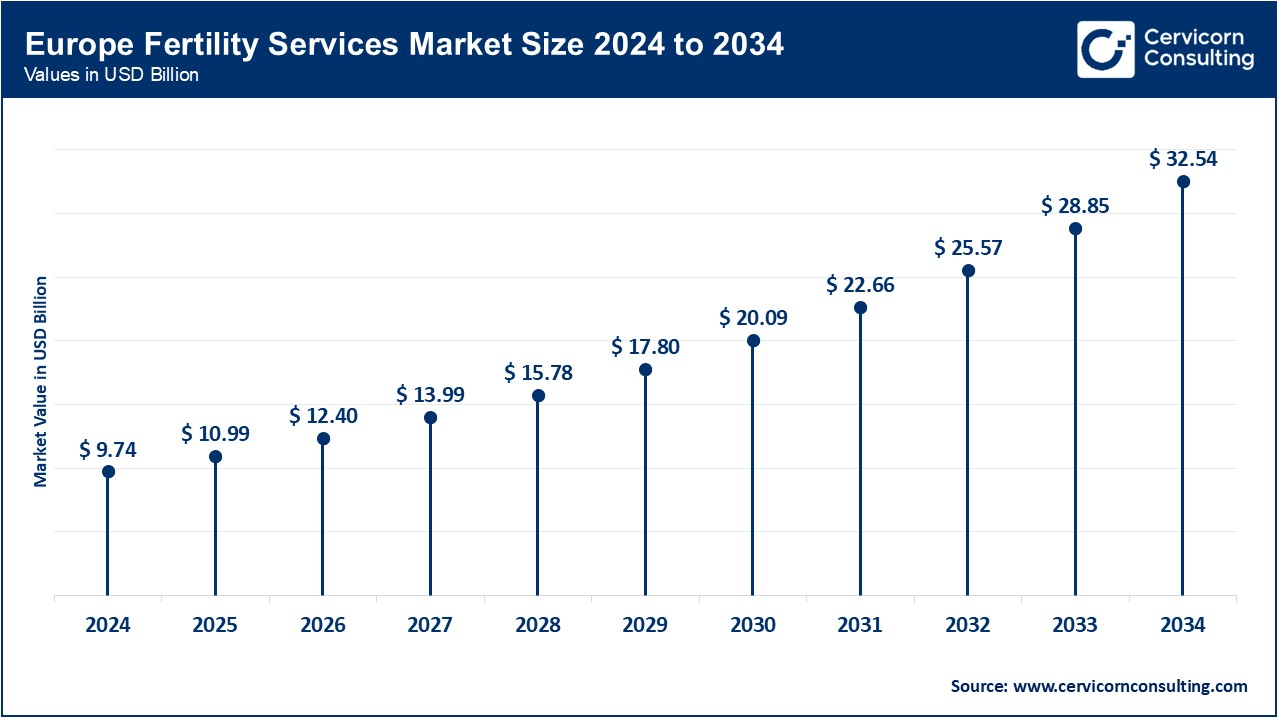

The Europe region accounts for one of the highest market shares. Germany, UK, and France are some of the countries involved. Improving health care systems as well as awareness of fertility problems have resulted in increased demand for ART services. For example, the UK and Germany's fertility treatment markets are heavily regulated to allow a patient to reach state-of-the-art medical technology. On the other hand, varying laws of European countries such as prohibition of freezing embryos or genetic testing might have an impact on the services that are available and the patients who can access it. Another reason for the increase in the fertility services market in Europe is the increasing rate of late childbearing among women.

The market is one of the promising markets in the Asia-Pacific region primarily because disposable incomes are increasing, social attitudes are altering, and awareness of fertility treatments is growing. The infertility rates in China, India, Japan, and South Korea are rising. So are the numbers of couples going in for IVF. Some areas are even shunned from discussions and awareness programs. As the incidence of infertility rises and the access to health facilities expands, coupled with the governments' reproductive health promotional strategies, the fertility services market is also seeing an increase in the Asia-Pacific region.

The market is growing in the LAMEA region, Latin America, Middle East, and Africa, though less than that in North America and Europe. Countries in Latin America, from Brazil to Mexico and Argentina, have made giant strides in fertility treatments, with growing awareness and better access to ART. On the other hand, advanced fertility treatments in the Middle East, mainly in the UAE and Saudi Arabia, are highly becoming acceptable to modernize conventional beliefs within cultural and religious confines. The African market is still very small, yet services are few and far between, but it has growing interest in fertility treatment options.

CEO Statements

Bruce Shook, CEO of TMRW Life Sciences

"Investments into fertility startups have reached an all-time high, up 89% from the previous year. Despite declining birth rates, interest in fertility services has surpassed pre-pandemic levels."

Dr. Helen O'Neill, CEO of Hertility Health

"Fundraising for our women's health start-up has been as painful as giving birth, but it’s worth it to provide at-home hormone health and fertility testing that reduces the time to diagnosis for conditions like endometriosis."

Market Segmentation

By Type

By Procedure

By Services

By End-User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Fertility Services

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Procedure Overview

2.2.3 By Services Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Infertility Trends

4.1.1.2 Egg Freezing Market Expands

4.1.1.3 Global Infertility Awareness Programs

4.1.2 Market Restraints

4.1.2.1 Expensive Fertility Treatments

4.1.2.2 Ethical and Religious Issues

4.1.3 Market Challenges

4.1.3.1 High cost of treatment

4.1.3.2 Ethical and Religious Issues

4.1.4 Market Opportunities

4.1.4.1 Growing IVF awareness

4.1.4.2 Advances in Genetics Testing

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Fertility Services Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Fertility Services Market, By Type

6.1 Global Fertility Services Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Diagnosis

6.1.1.2 Treatment

6.1.1.3 Preservation

Chapter 7. Fertility Services Market, By Procedure

7.1 Global Fertility Services Market Snapshot, By Procedure

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Assisted Reproductive Technology (ART)

7.1.1.2 In-Vitro Fertilization (IVF)

7.1.1.3 Artificial Insemination

7.1.1.4 Surrogacy

7.1.1.5 Others

Chapter 8. Fertility Services Market, By Services

8.1 Global Fertility Services Market Snapshot, By Services

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Donor Services

8.1.1.2 Non-donor Services

Chapter 9. Fertility Services Market, By End-User

9.1 Global Fertility Services Market Snapshot, By End-User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Fertility Clinics

9.1.1.2 Hospitals

9.1.1.3 Clinical Research Institutes

9.1.1.4 Surgical Centers

Chapter 10. Fertility Services Market, By Region

10.1 Overview

10.2 Fertility Services Market Revenue Share, By Region 2024 (%)

10.3 Global Fertility Services Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Fertility Services Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Fertility Services Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Fertility Services Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Fertility Services Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Fertility Services Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Fertility Services Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Fertility Services Market, By Country

10.5.4 UK

10.5.4.1 UK Fertility Services Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Fertility Services Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Fertility Services Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Fertility Services Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Fertility Services Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Fertility Services Market, By Country

10.6.4 China

10.6.4.1 China Fertility Services Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Fertility Services Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Fertility Services Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Fertility Services Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Fertility Services Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Fertility Services Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Fertility Services Market, By Country

10.7.4 GCC

10.7.4.1 GCC Fertility Services Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Fertility Services Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Fertility Services Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Fertility Services Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Olympus Corporation

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 The Cooper Companies Inc.

12.3 Instituto Bernabeu

12.4 VirtusHealth

12.5 CooperSurgical, Inc.

12.6 Vitrolife

12.7 Care Fertility

12.8 INVO Bioscience

12.9 Monash IVF

12.10 Fertility Focus Limited

12.11 Carolinas Fertility Institute

12.12 Apollo Hospitals Enterprise Ltd.

12.13 Merck KGaA

12.14 LABOTECT GMBH

12.15 Medicover AB