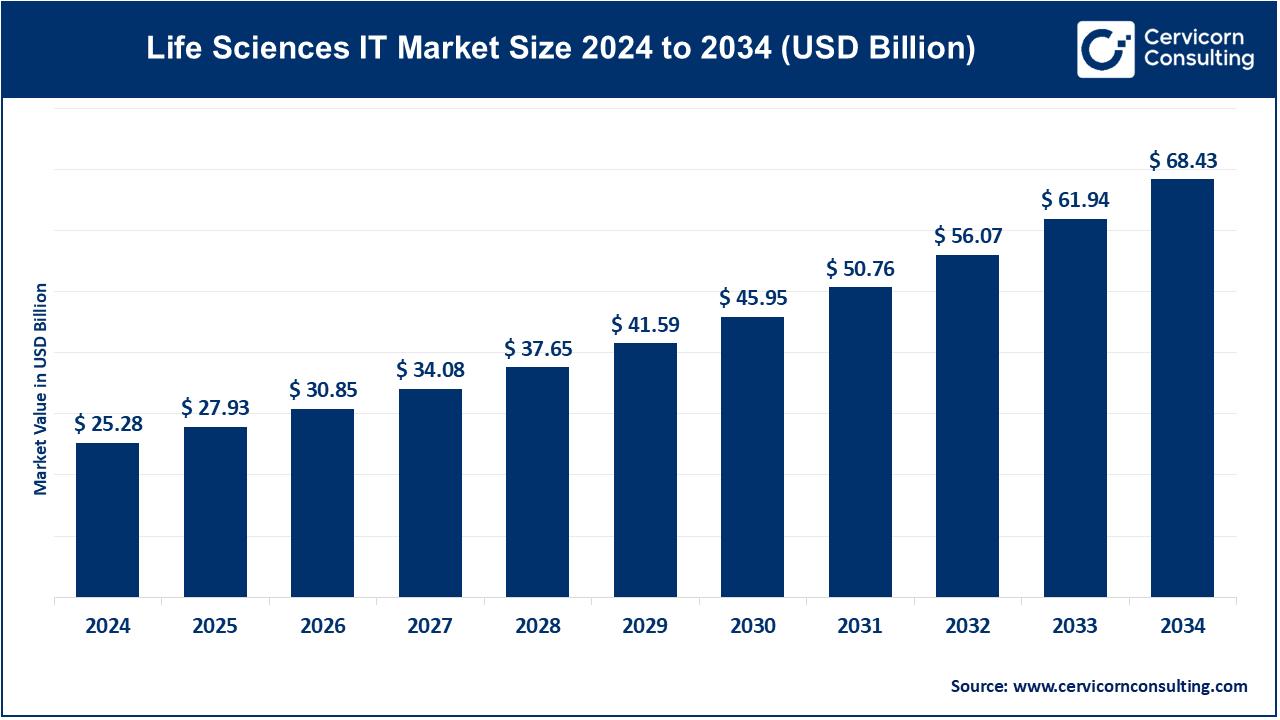

The global life sciences IT market size was valued at USD 25.28 billion in 2024 and is expected to hit around USD 68.43 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.47% over the forecast period from 2025 to 2034. The life sciences IT market is exhibiting rapid growth thanks to the factors, such as increased digitization of the healthcare systems, increase in data generation from clinical trials and research, and growing demand for data analytics and management tools. The adoption of AI, machine learning, and cloud computing accelerated further growth of the market in the Life Science domain. For instance, regulatory pressures for compliance, superior patient care, and demand for personalized medicine will also lead to a higher demand for state-of-the-art IT infrastructure in the life sciences.

Life Sciences IT signifies the information technology chiefly meant for life sciences sectors: pharmaceutical, biotechnology, and hospitals. Life Sciences IT embodies software, systems, and tools to ease drug discovery and clinical trials of patient care, as well as compliance with several regulatory requirements. Life Sciences IT facilitates real-time analysis, post-decision-making, and thus improves patient outcomes. Some applications are EHRs, LIMS, and research data under cloud computing. This technology facilitates handling huge volumes of data and streamlining processes and collaborations in the life sciences sector.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 27.93 Billion |

| Expected Market Size in 2034 | USD 68.43 Billion |

| Projected Market Growth 2025 to 2034 | 10.47% |

| Prime Region | North America |

| Booming Region | Asia-Pacific |

| Key Segments | Solution, Type, End User, Region |

| Key Companies | Genedata AG, Qiagen NV., Clario, Thermo Fisher Scientific Inc., Revvity, Inc., Oracle Corporation, IBM Corporation, DNAnexus, Inc., Illumina, Inc., Agilent Technologies, Inc. |

Drug Discovery Informatics: Drug discovery informatics uses computational tools and techniques in aid of drug candidates' discovery. It combines the applications of data mining, molecular modeling, and bioinformatics that predict behavior, compound to drug. In many ways, this saves enormous amounts of time and cost spent by the drug in the entire discovery process in conventional drug development. Therefore, it shall ease the research efforts of the pharmaceutical companies into smoothing out promising leads in their search for novel drug compounds.

Clinical trial management: Basically, this IT solution is just termed the monitoring, managing, and optimization of clinical trials. Tool activity involves parts of data collection, patients enrolled, compliance with regulatory practices, and following progress made. They ensure strict compliance with the regulation compliances through the prevention of error-prone and improve efficiency in clinical trial with a reduced number of errors within it. Clinical trials are kept back on track within budget due to real-time data analysis during the decision-making process.

Bioinformatics: Bioinformatics can be defined as the application of IT tools that are used for processing, analysis, and interpreting biological data such as genomic, proteomic, and clinical in nature. Through a series of databases, algorithms, and software tools, it interprets the complex mechanisms and understands the difficult biological conditions or diseases. Through bioinformatics, biologists will be empowered with the ability to interpret the genetic differences and have better drug designing while designing medicines according to body types. The usage has also gained significance in the areas of genomics, diagnostics, and innovation in the treatment.

Laboratory Information Management (LIMS): LIMS solution helps manage the samples, as well as any associated data or workflows, extremely efficiently. Routine tasks such as sample tracking and test result reporting are automated by LIMS while enhancing traceability with improved accuracy that streamlines entire processes. Being a very high-value application due to the strong need for appropriate and real-time data management with respect to drug development and maintaining regulatory compliance within pharmaceutical, biotechnology, as well as in clinical research contexts, LIMS plays a significantly important role.

Software: In the Life Sciences IT market, software solutions are providing tools needed in data analysis, patient management, research, and regulatory compliance. Among these software systems include drug discovery platforms, clinical trial management systems, bioinformatics tools, and LIMS. With such functions, the software solution is there to automate and make simple the life sciences process to improve efficiency, which basically forms an essential tool for making decisions, innovating, and achieving excellence in operation in pharmaceutical and healthcare organizations.

Service: Services in the life sciences IT market include consulting, system integration, software support, and cloud-based solutions that focus on optimizing the IT infrastructure and operations. This helps life science organizations implement complex IT systems based on their own needs. The managed services provide assurance that systems are running correctly, while consulting ensures that organizations find the best route for digital transformation, helping select and deploy technology that best suits their needs for research and operations.

Pharmaceutical and Biotechnology Industries: The primary end-users of Life Sciences IT solutions are pharmaceutical and biotechnology companies. Critical areas for these companies include drug discovery, clinical trials, regulatory compliance, and production processes that rely on IT systems. Software solutions drive faster R&D cycles, optimize supply chains, and support the efficient manufacturing of therapeutics of high quality. As the industry continues embracing digital transformation, pharmaceutical and biotechnology companies look to their IT infrastructures to compete in this data-based world.

CROs or contract research and development organizations: Contract research organizations (CROs) are outsourced services to a pharmaceutical and biotechnology company mostly in clinical research, regulatory affair, and other laboratory research studies. These institutions use IT applications to manage diverse data from diverse clients, assist in optimizing trials, and even ensure compliance of the regulatory conditions. CROs play a crucial role in the acceleration process of drug discovery and often utilize various IT solutions, which enable offering cost-effective yet efficient services within the life science sector.

The life sciences IT market can be broadly divided into several key regions, such as North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). This section will elaborate on each region in detail:

North America is the largest contributor of the market as large pharmaceutical firms, advanced research facilities, and good healthcare infrastructures are present in North America. In fact, the United States and Canada primarily are North America, of which the United States contributes more toward health IT adoption and drug discovery, clinical trials, and digital health solutions. In fact, for example, in June 2021, New York City plans to increase life sciences funding by doubling investment from USD 500 million to USD 1 billion, which is through the LifeSci NYC initiative aimed at creating 40,000 jobs and to be a world leader in that industry. Such funding will provide money for medical innovations research and development, better infrastructure of public health, and ensuring access to quality health care equally among neighborhood. Strong focus on innovation, R&D investment, and healthcare reforms in the region are driving market growth and technology adoption.

Life Sciences IT's largest share can be attributed to the well-developed health care systems of the region and sophisticated pharmaceutical research facilitated by government policies toward digital transformation. In the realms of personalized medicine, regulatory compliance, and clinical trials, Germany, UK, France, and Switzerland lead. Data privacy and security are major issues that dominate the agenda in EU, and market growth reflects these factors. France 2030 is an initiative with a plan of USD 55.29 billion, companies like METHYS Dx, and Astraveus lead in the area of cancer detection and gene therapy.

Asia-Pacific is growing rapidly in the IT market for Life Sciences, particularly in China, Japan, India, and South Korea. Asia-Pacific has evolved as a hub of biotechnology innovation, pharmaceutical manufacturing, and clinical research. With investment in digital health solutions and personalized medicine, health infrastructure is increasingly demanding IT solutions. For instance, the company, on February 2024, struck an investment agreement amounting to USD 30m with AN Venture Partners-a worldwide capital fund focused on turning scientific innovations from Japan into biotechnology firms. That is going to boost its corporate value in the process as it develops firms in the United States market, the largest biotechnology market. For this, as a result of personnel cooperation with ANV, Otsuka will benefit through dividends, investments, and further know-how when nurturing new sciences.

Emerging markets are being seen for Life Sciences IT solutions in the key countries Brazil, Mexico, South Africa, and the UAE. The market is still at its developing stage, but growing demand for IT infrastructure to improve healthcare services, clinical trials, and drug development is being experienced. Governmental initiatives along with a growing interest in health care system delivery in that region will open the gates for IT integration, especially from the pharmaceuticals and biotech industries. For instance, in December 2023, Latin America's leading healthcare market allocated 9.47% of its GDP, which amounts to USD 161 billion. In this integrated health care form, it covered 72 percent of the country's population for all the necessary services as well as their medicines. In the year 2023, SUS declared an investment of USD 200 million to become digital, which further enhanced the health IT infrastructure and telemedicine access in the country.

CEO Statements

Othmar Pfannes, CEO of Genedata AG:

Thierry Bernard, CEO of Qiagen NV.:

Prahlad Singh, CEO of Revvity, Inc.:

Market Segmentation

By Solution

By Type

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Life Sciences IT

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Solution Overview

2.2.2 By Type Overview

2.2.3 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing investment in healthcare and pharma R&D

4.1.1.2 The rising need for real-time monitoring and analytics on health

4.1.1.3 Collaborations between tech companies and healthcare providers

4.1.2 Market Restraints

4.1.2.1 High implementation cost

4.1.2.2 A Resistance to change

4.1.2.3 Limited investment from smaller organizations

4.1.3 Market Challenges

4.1.3.1 Keeping up with the rapid pace of technological change

4.1.3.2 The health care industry is fragmented

4.1.3.3 The complexity in managing multi-source data

4.1.4 Market Opportunities

4.1.4.1 Genomics and biotechnology research growth

4.1.4.2 Growing demand for wearable health technology

4.1.4.3 Niche-specific solution development for niche markets

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Life Sciences IT Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Life Sciences IT Market, By Solution

6.1 Global Life Sciences IT Market Snapshot, By Solution

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Drug Discovery Informatics

6.1.1.2 Clinical Trial Management

6.1.1.3 Bioinformatics

6.1.1.4 Laboratory Information Management

Chapter 7. Life Sciences IT Market, By Type

7.1 Global Life Sciences IT Market Snapshot, By Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Software

7.1.1.2 Service

Chapter 8. Life Sciences IT Market, By End-User

8.1 Global Life Sciences IT Market Snapshot, By End-User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Pharmaceutical and Biotechnology Companies

8.1.1.2 Contract Research and Development Organizations

8.1.1.3 Others

Chapter 9. Life Sciences IT Market, By Region

9.1 Overview

9.2 Life Sciences IT Market Revenue Share, By Region 2024 (%)

9.3 Global Life Sciences IT Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Life Sciences IT Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Life Sciences IT Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Life Sciences IT Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Life Sciences IT Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Life Sciences IT Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Life Sciences IT Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Life Sciences IT Market, By Country

9.5.4 UK

9.5.4.1 UK Life Sciences IT Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Life Sciences IT Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Life Sciences IT Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Life Sciences IT Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Life Sciences IT Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Life Sciences IT Market, By Country

9.6.4 China

9.6.4.1 China Life Sciences IT Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Life Sciences IT Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Life Sciences IT Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Life Sciences IT Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Life Sciences IT Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Life Sciences IT Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Life Sciences IT Market, By Country

9.7.4 GCC

9.7.4.1 GCC Life Sciences IT Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Life Sciences IT Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Life Sciences IT Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Life Sciences IT Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Genedata AG

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Qiagen NV.

11.3 Clario

11.4 Thermo Fisher Scientific Inc.

11.5 Revvity, Inc.

11.6 Oracle Corporation

11.7 IBM Corporation

11.8 DNAnexus, Inc.

11.9 Illumina, Inc.

11.10 Agilent Technologies, Inc.