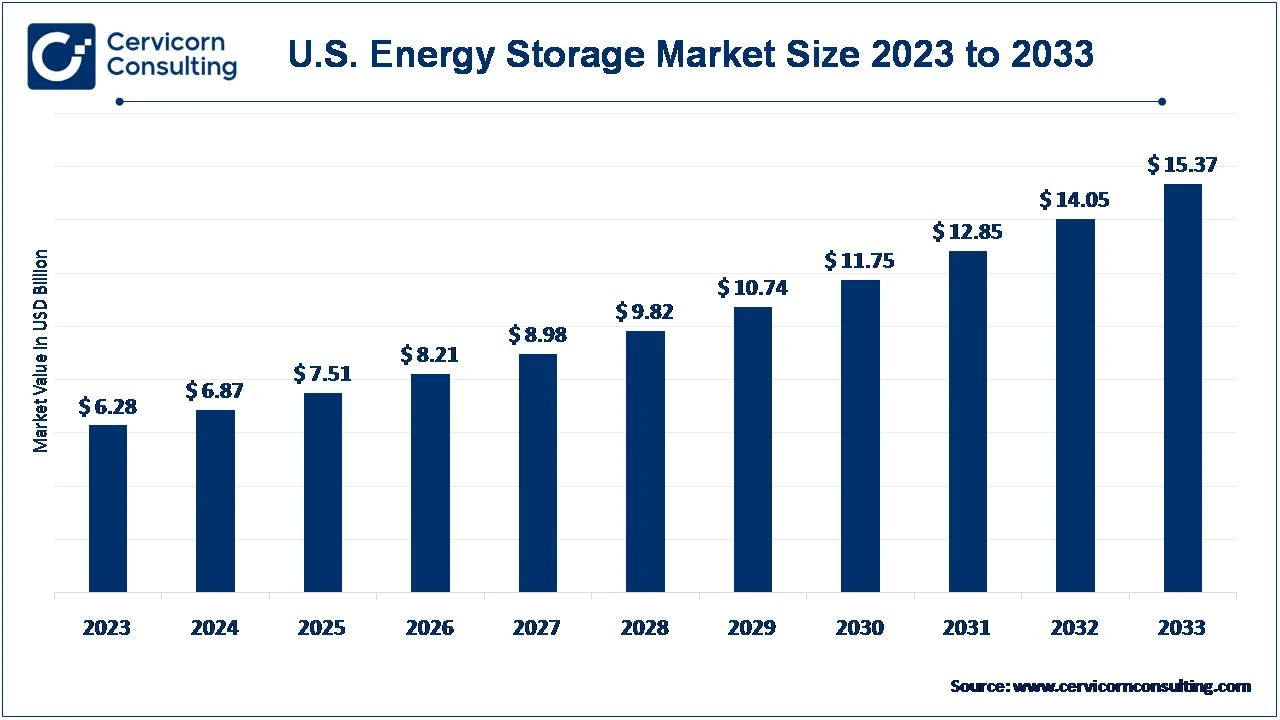

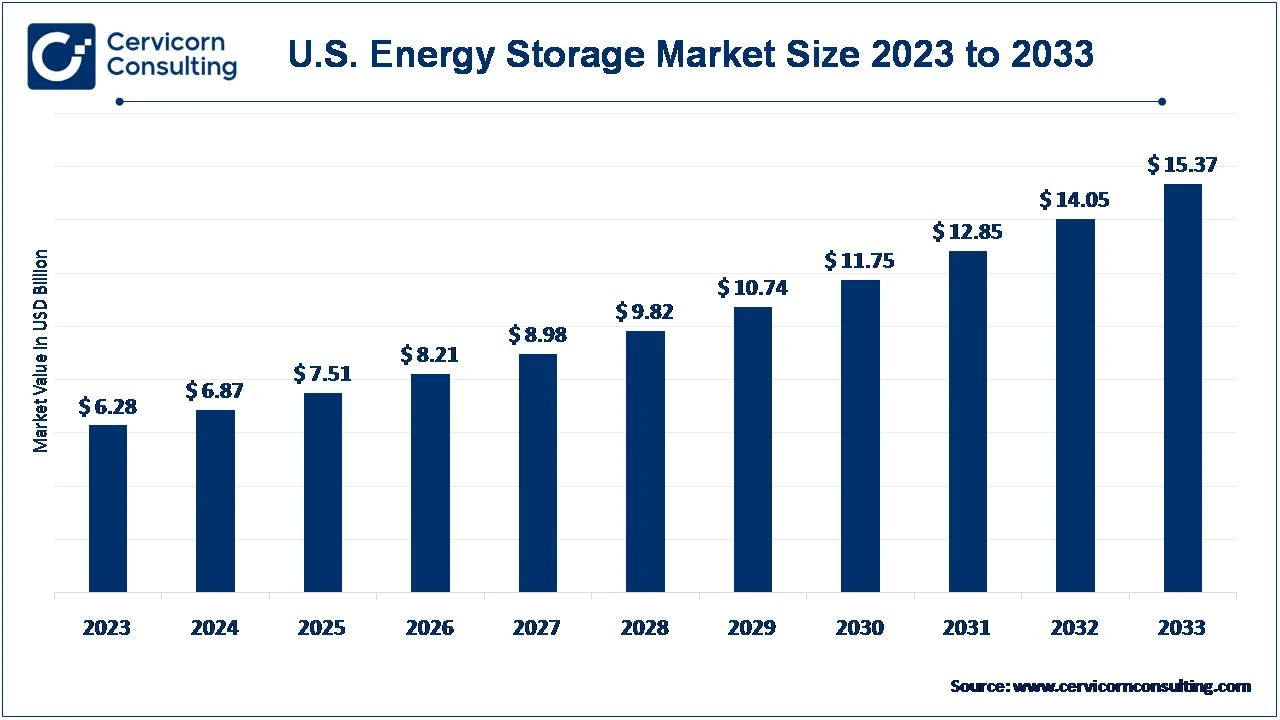

U.S. Energy Storage Market Size and Growth 2024 to 2033

The U.S. energy storage market size was valued at USD 6.87 billion in 2024 and is expected to hit around USD 15.37 billion by 2033, growing at a CAGR of 9.36% from 2024 to 2033. The energy storage market in the U.S. is experiencing rapid growth due to increasing renewable energy adoption, government incentives, the growing adoption of electric vehicles and advancements in battery technology. The rise of electric vehicles and smart grid infrastructure has further accelerated demand. States like California, Texas, and New York lead in deployments, promoting policies that encourage energy storage adoption. With the push for clean energy and carbon reduction, the market is expected to grow significantly in the coming years.

The U.S. energy storage market is a dynamic sector focused on delivering a range of energy solutions, including utility-scale storage, commercial and industrial storage, residential storage, microgrids, and EV charging infrastructure. Driven by technological advancements like lithium-ion and solid-state batteries and increasing demand for renewable energy integration, the market is expanding rapidly. Despite challenges like high initial costs and regulatory compliance, the market remains robust and continues to evolve.

Energy storage is defined as the process whereby energy produced at any one time may be captured and stored for later use. It is a fundamental constituent of contemporary energy systems-able to balance supply and demand-particularly in the context of increased deployment of variable renewable sources of energy, the majority of which are intermittent, like wind and solar. A variety of technologies is involved in the energy storage market, including batteries, pumped hydro, thermal storage, and flywheels. These are used in a field of applications that range from grid stabilization to providing backup power.

- The Biden-Harris administration announced an investment worth $63 million to transform the manufacturing sector in the United States. Under the charismatic leadership of the U.S. Department of Energy, the leading charge is towards the better recycling of batteries and smart manufacturing under the umbrella of the "Investing in America" agenda.

- In 2022, annual renewable energy generation in the United States surpassed coal for the first time, according to the U.S. Department of Energy. The period by 2025 will likely witness about a 75% increase in domestic solar generation, with wind rising by 11%.

Key Insights Beneficial to the U.S. Energy Storage Market

- Lithium-ion battery prices dropped by over 80% since 2010, making storage more affordable.

- The U.S. energy storage deployment reached 10+ GW in 2023, a record high.

- Federal tax credits and incentives under the Inflation Reduction Act boosted market investments.

- The residential storage market grew by 30% YoY, driven by solar panel adoption.

- Utility-scale projects accounted for over 80% of new deployments in 2023.

U.S. Energy Storage Market Growth Factors

- More Integration of Renewable Energy: As more renewable energy sources, like solar and wind, integrate into power systems, the demand is required for active energy storage to balance out these intermittent sources. The energy storage systems stabilize the grid by storing excess energy produced at peak production times and releasing it during periods of low production. The result is a truly successful integration into the move toward a more sustainable energy infrastructure while keeping the power consistent and reliable.

- Government Incentives and Policies: Federal and state policies, such as tax incentives, grants, and regulatory support, become so imperative in stirring investment into energy storage technologies. Programs like the Investment Tax Credit for solar energy systems with storage components help reduce financial burden on investors and accelerate market deployment of these energy systems. These types of incentives would certainly be the driver for deploying energy storage systems throughout the United States.

- Development of Technology: Advances in battery technologies, such as those with Li-ion and solid-state batteries, are very promising for enhancing the efficiency, life, and safety of energy storage systems. The advance in these technologies has helped reduce the cost and has made the solutions more viable in residential and commercial applications. It allows scaling of storage solutions in large grid applications since there's improved battery performance.

- Grid Modernization: As the power grid infrastructure ages, there is an increasing need for modernization with better advanced energy storage solutions. Advanced grids need systems that are flexible and resilient in meeting the varied energy sources and fluctuations in demands. Energy storage helps balance supply and demand, helps prevent outages, thereby enhancing the overall reliability and resilience of the grid.

- Growing Demand for Electric Vehicles: Growing demand for electric vehicles, in turn, increases the demand for energy storage systems that will support the EV charging infrastructure. Energy storage will help manage peak load demands and reduce the strain caused on the grid by multiple simultaneous charges. In addition to that, vehicle-to-grid technologies will allow EVs to supply the stored energy back into the grid for improved stability.

- Increased attention on sustainability: Huge awareness is brought among people, and efforts are pumped into reducing carbon emissions; thus, huge investments are made in energy storage related to sustainable energy solutions. Energy storing systems make it possible for renewable energies to be utilized productively, given the reduction in dependence on fossil fuels and reduced greenhouse gases in the atmosphere. This green factor drives storage technologies deeper in residential, commercial, and industrial sectors.

- Energy Resilience and Backup Power: The increasing frequency of natural calamities and grid failures is casting up the demand for energy storage systems for reliable backup power. Energy storage increases the resilience of energy by enabling constant power supply in cases of emergency, thereby sustaining critical infrastructure and reducing the impact of power supply interruption. This capability is especially needed for residential users and businesses alike that require uninterrupted power to continue operational processes.

U.S. Energy Storage Market Trends

- Increased Adoption of Advanced Technology: The U.S. energy storage market is witnessing a significant shift towards advanced technologies. Innovations in battery technologies, including lithium-ion and solid-state batteries, are becoming standard. These technologies enhance storage efficiency, reduce costs, and improve performance. The integration of artificial intelligence (AI) for energy management and predictive maintenance is also emerging, further revolutionizing the field. This trend reflects a broader move towards more efficient, accurate, and sustainable energy storage solutions.

- Rising Demand for Renewable Energy Integration: There is a growing emphasis on integrating renewable energy sources, driven by increasing focus on sustainability and reducing carbon footprints. Energy storage systems are essential for managing the intermittency of renewable energy sources like solar and wind. This trend is influenced by government policies, corporate sustainability goals, and consumer demand for cleaner energy. As renewable energy adoption increases, energy storage solutions become a critical component of the energy infrastructure.

- Expansion of Grid Modernization Initiatives: The expansion of grid modernization initiatives is making energy storage more accessible and integral to the power grid. Enhanced grid infrastructure and smart grid technologies are reducing barriers and encouraging the deployment of advanced energy storage systems. This trend is particularly important for increasing grid reliability, managing peak loads, and integrating distributed energy resources, thus driving market growth.

- Growth in Electric Vehicle (EV) Adoption: There is a strong shift towards the adoption of electric vehicles, which drives demand for energy storage solutions. EV batteries not only require energy storage for charging but also offer potential for vehicle-to-grid (V2G) integration, where EVs can supply energy back to the grid. This trend is supported by advancements in battery technology and increasing investments in EV infrastructure, promoting a symbiotic growth between EVs and energy storage systems.

- Rise of Energy Resilience Solutions: Energy resilience is emerging as a transformative trend, driven by the need for reliable power during grid outages and natural disasters. The COVID-19 pandemic and climate-related disruptions have accelerated the adoption of energy storage systems for backup power. This trend improves energy security, especially in critical infrastructure and residential areas, and supports continuity of operations during disruptions, making energy storage solutions more flexible and essential.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 7.51 Billion |

| Projected Market Size in 2033 |

USD 15.37 Billion |

| Growth Rate (2024 to 2033) |

9.36% |

| Segments Covered |

Service, Application, End User, Region |

| Key Players |

Tesla, Inc., Fluence, NextEra Energy Resources, LG Energy Solution, AES Corporation, Siemens Energy, General Electric (GE), BYD Company Ltd., ABB Ltd., Panasonic Corporation, Sunrun Inc., Enphase Energy, Stem, Inc., Eos Energy Enterprises, Northvolt |

U.S. Energy Storage Market Dynamics

Drivers

Increasing Renewable Energy Integration

- The growing adoption of renewable energy sources, such as solar and wind, necessitates effective energy storage solutions to manage intermittency and ensure a stable energy supply. Energy storage systems help balance the grid by storing excess energy during peak production times and releasing it during low production periods, facilitating a more sustainable energy infrastructure.

Regulatory and Policy Support

- Government regulations and policies, including tax incentives and grants, support the growth of the U.S. Energy Storage Market. Initiatives like the Investment Tax Credit (ITC) for energy storage systems encourage investments and adoption, fostering market expansion by reducing financial barriers and promoting renewable energy integration.

Restraints

High Initial Costs

- The high initial costs of energy storage systems remain a significant restraint. Although costs are decreasing, the substantial upfront investment required for installation and integration can be a barrier for many potential users, particularly small-scale residential and commercial projects, limiting market growth.

Limited Lifespan and Degradation

- The limited lifespan and degradation of current battery technologies, such as lithium-ion, pose challenges. Over time, energy storage systems lose capacity and efficiency, requiring replacements and increasing the total cost of ownership. This can deter potential users from investing in energy storage solutions.

Opportunities

Growth of Advanced Battery Technologies

- Advancements in battery technologies, including solid-state batteries and flow batteries, present significant opportunities. These innovations promise longer lifespans, higher efficiency, and improved safety, potentially reducing costs and expanding the market. Investing in research and development of these technologies can drive substantial growth.

Expansion of Distributed Energy Resources (DER)

- The growth of distributed energy resources, such as residential solar panels paired with home energy storage systems, offers a promising opportunity. As more consumers adopt decentralized energy solutions, the demand for small-scale, efficient energy storage systems will increase, promoting market expansion and energy independence.

Challenges

Regulatory Compliance and Standards

- Navigating complex regulatory requirements and maintaining compliance with evolving standards pose significant challenges. Ensuring adherence to safety, performance, and environmental regulations can be resource-intensive and may hinder the rapid deployment of energy storage systems.

Integration of Emerging Technologies

- Integrating emerging energy storage technologies with existing energy infrastructure can be challenging. Compatibility issues, the need for grid upgrades, and the lack of standardized protocols can create barriers to seamless integration, impacting the overall efficiency and reliability of energy storage solutions.

U.S. Energy Storage Market Segment Analysis

Service Type Analysis

Utility-Scale Storage: Utility-scale energy storage services are growing due to their ability to balance grid supply and demand. Advanced technologies like lithium-ion and flow batteries enable large-scale storage, supporting renewable energy integration and grid stability. These systems provide peak shaving, frequency regulation, and backup power, enhancing overall grid reliability.

Commercial & Industrial Storage: Commercial and industrial energy storage solutions are expanding as businesses seek to reduce energy costs and improve resilience. These systems allow for peak demand management, load shifting, and backup power, ensuring continuous operations and cost savings. The adoption of these systems is driven by advancements in battery technology and declining costs.

Residential Storage: Residential energy storage services are on the rise as homeowners look to increase energy independence and resilience. Home battery systems store excess solar energy for use during outages or peak demand periods, providing reliability and cost savings. The growth in residential storage is fueled by decreasing battery costs and increasing adoption of solar PV systems.

Microgrids: Microgrid energy storage services are crucial for providing reliable and resilient power to localized areas. These systems integrate renewable energy sources and storage to create independent power networks. Microgrids enhance energy security and efficiency, particularly in remote or disaster-prone areas, driving their adoption.

EV Charging Infrastructure: Energy storage solutions are essential for supporting the growing electric vehicle (EV) market. Storage systems at charging stations manage peak loads, store renewable energy, and ensure efficient power distribution. The expansion of EV infrastructure is driven by the increasing adoption of electric vehicles and the need for sustainable charging solutions.

Application Analysis

Renewable Energy Integration: Energy storage is crucial for integrating renewable energy sources like solar and wind into the grid. These storage systems manage the intermittency of renewable power by storing excess energy during peak production and releasing it during low production periods. This capability ensures a stable and reliable energy supply, which is essential for achieving sustainable energy goals and reducing carbon emissions.

Grid Stability and Reliability: Energy storage solutions enhance grid stability and reliability by providing critical services such as frequency regulation, voltage support, and black start capabilities. These systems help maintain a resilient power grid, capable of handling fluctuations and preventing outages. By stabilizing the grid, energy storage supports consistent power delivery and enhances overall grid performance.

Peak Shaving and Load Shifting: Energy storage systems play a key role in managing energy demand through peak shaving and load shifting. By storing excess power during low-demand periods and releasing it during peak times, these systems reduce the need for expensive peak power plants. This application not only lowers energy costs for consumers but also helps utilities manage demand more efficiently.

Backup Power: Energy storage provides reliable backup power for critical infrastructure, homes, and businesses during outages. These systems ensure continuous operations and enhance energy security, especially in areas prone to natural disasters or grid failures. Backup power from energy storage systems is vital for maintaining essential services and preventing disruptions.

Energy Arbitrage: Energy storage systems enable energy arbitrage, allowing operators to buy electricity during low-cost periods and sell it during high-cost periods. This application provides financial benefits to energy storage operators by capitalizing on price differentials. Additionally, energy arbitrage helps stabilize energy prices by balancing supply and demand across different times of the day.

End-users Analysis

Utilities: Utilities are significant users of energy storage systems for grid management and stability. These storage solutions enable utilities to integrate renewable energy sources, manage peak demand efficiently, and ensure reliable power delivery to customers. By enhancing grid performance and reliability, energy storage systems drive market growth and support the transition to a more sustainable energy infrastructure.

Commercial and Industrial Users: Businesses and industrial facilities utilize energy storage to manage energy costs, ensure reliable power, and support sustainability initiatives. These systems provide critical services such as peak demand management, load shifting, and backup power, which enhance operational efficiency. By adopting energy storage, commercial and industrial users can achieve energy resilience and cost savings, driving market expansion.

Residential Users: Homeowners increasingly adopt energy storage systems to complement their solar PV installations, providing energy independence and resilience. Residential storage solutions offer reliable backup power during outages and help reduce electricity bills by storing excess solar energy for later use. This growing adoption of home energy storage systems is driven by the desire for greater energy security and financial benefits.

Government and Military: Government and military facilities rely on energy storage for energy security and operational resilience. These storage systems provide reliable power for critical operations, enhancing the sustainability and reliability of government infrastructure. By integrating energy storage, government and military entities can ensure continuous operations and reduce reliance on traditional power sources, contributing to national energy security.

Remote and Off-Grid Communities: Remote and off-grid communities depend on energy storage to provide reliable and sustainable power. These systems integrate renewable energy sources, such as solar and wind, with storage solutions to create independent power networks. By enabling energy access and resilience in remote areas, energy storage supports the development of sustainable communities and reduces reliance on fossil fuel.

U.S. Energy Storage Market Top Companies

- Tesla, Inc.

- Fluence

- NextEra Energy Resources

- LG Energy Solution

- AES Corporation

- Siemens Energy

- General Electric (GE)

- BYD Company Ltd.

- ABB Ltd.

- Panasonic Corporation

- Sunrun Inc.

- Enphase Energy

- Stem, Inc.

- Eos Energy Enterprises

- Northvolt

Among the new players, Fluence Energy leverages advanced battery technologies and energy management software to offer innovative and scalable energy storage solutions. Stem, Inc. focuses on expanding its AI-driven energy storage platform through strategic partnerships and a strong emphasis on smart energy solutions.

Dominating players like Tesla, Inc. and NextEra Energy Resources drive market leadership through extensive project portfolios and high-quality technology standards. Tesla is known for its aggressive expansion strategy and integration of cutting-edge battery technology, while NextEra excels in operational efficiency and renewable energy projects, enhancing overall grid reliability and maintaining a competitive edge in the market.

CEO Statements

David Kim, CEO of LG Energy Solution

- "By concentrating on qualitative growth, we will secure a concrete business structure and a strong foothold for sustainable growth. This year will mark the start of the ‘LG Energy Solution 2.0 era,’ reinforcing our fundamental competitiveness including technology leadership and realizing differentiated customer values."

John Ketchum, Chairman and CEO of NextEra Energy

- "Our vision is that clean energy cannot be priced as a luxury good or a nice-to-have. Clean energy must help save customers money on their electric bill."

Anders Opedal, president and CEO of Equinor

- "We will provide a broader energy offering with lower emissions. We aim to grow renewables and decarbonised energy to more than 80 terawatt hours by 2035 and have increased our ambition for carbon storage."

Eric Dresselhuys, CEO of ESS Tech, Inc.

- "Combining ESS’ innovative technology and deployment experience with Honeywell’s storage and control system expertise will enable us to drive the clean energy transition and deliver value to our customers, shareholders, and communities."

Recent Developments

- In July 2024, Repsol acquired the U.S. solar and storage firm Hecate Energy. This strategic move aims to expand Repsol's presence in the renewable energy sector and enhance its portfolio in solar and energy storage solutions.

- In June 2024, Trina Storage launched its new cell-to-AC battery energy storage system (BESS) solution in the U.S. and signed its first project deal in Germany. This innovative solution is designed to enhance efficiency and integration in energy storage projects.

- In May 2024, RWE Clean Energy strengthened its U.S. renewable portfolio with the acquisition of solar and storage projects, enhancing its position in the U.S. market.

- In April 2024, The U.S. Department of Energy awarded $15 million to launch the Innovations in Long-Duration Energy Storage Earthshot initiative, aiming to accelerate the development and deployment of long-duration energy storage technologies and support the transition to a clean energy economy.

- In April 2024, Bitech Technologies and Bridgelink merged to expand their presence in the U.S. battery energy storage and solar markets and are preparing to list on NASDAQ.

Market Segmentation

By Service Type

- Utility-Scale Storage

- Commercial & Industrial Storage

- Residential Storage

- Microgrids

- EV Charging Infrastructure

By Application

- Renewable Energy Integration

- Grid Stability and Reliability

- Peak Shaving and Load Shifting

- Backup Power

- Energy Arbitrage

By End-users

- Utilities

- Commercial and Industrial Users

- Residential Users

- Government and Military

- Remote and Off-Grid Communities

...

...