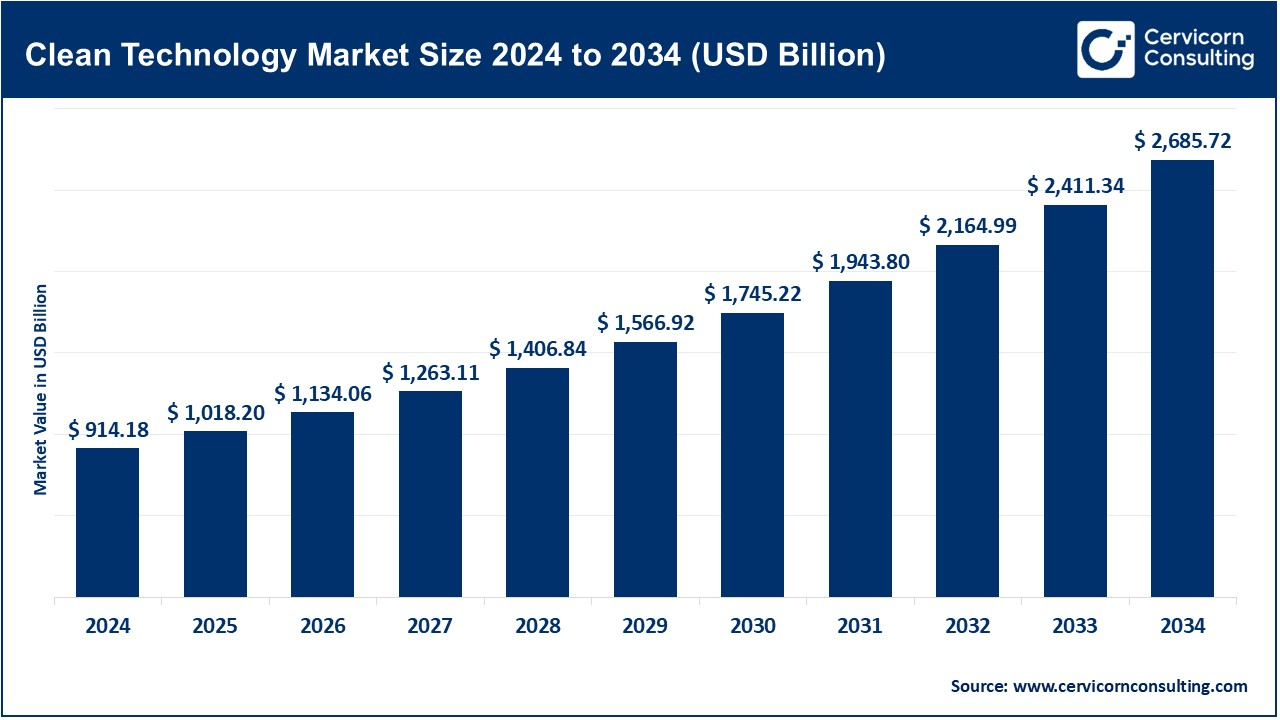

The global clean technology market size was valued at USD 914.18 billion in 2024 and is expected to be worth around USD 2,685.72 billion by 2034, exhibiting at a compound annual growth rate (CAGR) of 11.37% over the forecast period from 2025 to 2034. The clean technology market has been expanding rapidly due to increasing demand for renewable energy, stricter environmental regulations, and growing corporate sustainability initiatives. Governments worldwide are providing incentives for clean energy adoption, while businesses are shifting towards greener operations to meet carbon neutrality goals. The rise of electric vehicles, smart energy solutions, and circular economy practices is further fueling cleantech innovation.

Emerging markets in Asia-Pacific, Europe, and North America are leading the growth, driven by investments in solar, wind, and battery storage. The cost of renewable energy sources is declining, making them more accessible and competitive with fossil fuels. Additionally, advancements in AI, IoT, and big data are optimizing energy use and waste management, further enhancing cleantech adoption. As environmental concerns grow, cleantech will play a crucial role in shaping a sustainable global economy.

What is Clean Technology?

Clean Technology (Cleantech) refers to innovative products, services, and processes that reduce environmental impact while improving energy efficiency, resource sustainability, and economic performance. Cleantech includes renewable energy (solar, wind, hydro), energy storage (batteries, hydrogen fuel cells), water and waste management, sustainable agriculture, and eco-friendly industrial solutions. These technologies aim to minimize carbon emissions, reduce waste, and promote the use of renewable resources.

Governments, businesses, and consumers are increasingly adopting cleantech due to rising environmental concerns and stricter regulations on pollution. Companies are investing in green energy solutions, electric vehicles, and carbon capture technologies to align with global sustainability goals. Technological advancements, declining costs of renewable energy, and supportive policies are accelerating the adoption of cleantech across industries. Additionally, innovations in smart grids, energy-efficient buildings, and sustainable manufacturing are shaping a cleaner, greener future.

Surge in Clean Energy Investments

Global investments in clean energy technologies are projected to reach nearly USD 800 billion in 2024, reflecting a 10% to 20% increase from 2023. Solar energy remains the dominant sector, contributing to approximately 55% of total investments, while wind energy (both onshore and offshore) follows closely. Governments and private investors are rapidly shifting their focus toward battery energy storage, green hydrogen, and smart grids to enhance energy efficiency and grid reliability. The U.S. Inflation Reduction Act and the European Union’s Green Deal Industrial Plan have accelerated clean energy funding, making renewable energy sources cheaper and more accessible. Additionally, China, the world’s largest clean energy investor, is expected to install 200 GW of solar power in 2024, further fueling global market expansion.

Declining Costs of Renewable Energy Technologies

The cost of renewable energy technologies is decreasing due to technological advancements, economies of scale, and increasing competition. By 2030, the capital expenditure for solar and wind projects is expected to decline by 15% to 20%, making clean energy more cost-competitive with fossil fuels. Solar panel prices have already dropped by nearly 90% over the past decade, while wind turbine costs have fallen by over 50%. Battery prices, which are crucial for energy storage, have also witnessed a decline of nearly 80% since 2013, making energy storage more affordable. This cost reduction is further enhanced by automation, AI-driven efficiency improvements, and sustainable material sourcing, making renewable energy adoption more attractive to businesses and governments worldwide.

Expansion of Offshore Wind Energy

The offshore wind energy sector is experiencing record-breaking growth, with more than 60 GW of new offshore wind capacity scheduled for auction across 17 global markets in 2024. Europe leads the way, with the UK, Germany, and the Netherlands planning to triple their offshore wind installations by 2030. The U.S. has also announced plans to deploy 30 GW of offshore wind by 2030, backed by federal subsidies and tax credits. China, already a leader in offshore wind power, is set to install over 12 GW annually for the next decade. The growth in offshore wind is driven by improved turbine efficiency, floating wind technology, and stronger government commitments to achieving carbon neutrality. As a result, offshore wind projects are expected to generate clean electricity for millions of households worldwide, reducing dependency on fossil fuels.

Emphasis on Decarbonization by Manufacturers

Manufacturers in the clean energy sector are actively working to reduce the carbon footprint of their supply chains by adopting sustainable materials, optimizing production processes, and using renewable energy in manufacturing facilities. Major solar panel and wind turbine manufacturers are setting targets to achieve carbon neutrality by 2035, aligning with the Paris Agreement’s climate goals. Companies are also integrating circular economy principles, such as recycling old solar panels and repurposing wind turbine blades, to minimize waste. Additionally, AI-powered supply chain analytics are helping manufacturers track emissions across the entire production lifecycle, ensuring transparency and compliance with global regulations. These efforts not only enhance corporate sustainability but also improve cost efficiency and attract eco-conscious consumers who prioritize low-carbon products.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 1018.20 Billion |

| Expected Market Size in 2034 | USD 2685.72 Billion |

| Projected CAGR 2025 to 2034 | 11.37% |

| Dominant Region | Asia Pacific |

| Highest Growth Region | North America |

| Key Segments | Type, Application, Region |

| Key Companies | Siemens AG, General Electric (GE), Schneider Electric, Tesla, Inc., Vestas Wind Systems A/S, Ørsted A/S, ABB Ltd., First Solar, Inc., Enphase Energy, Inc., Brookfield Renewable Partners, NextEra Energy, Inc., Johnson Controls International plc |

Government Policies and Incentives

Corporate Sustainability Initiatives

High Initial Capital Expenditure

Regulatory and Policy Uncertainties

Technological Advancements

Emerging Markets

Supply Chain Constraints

Market Fragmentation

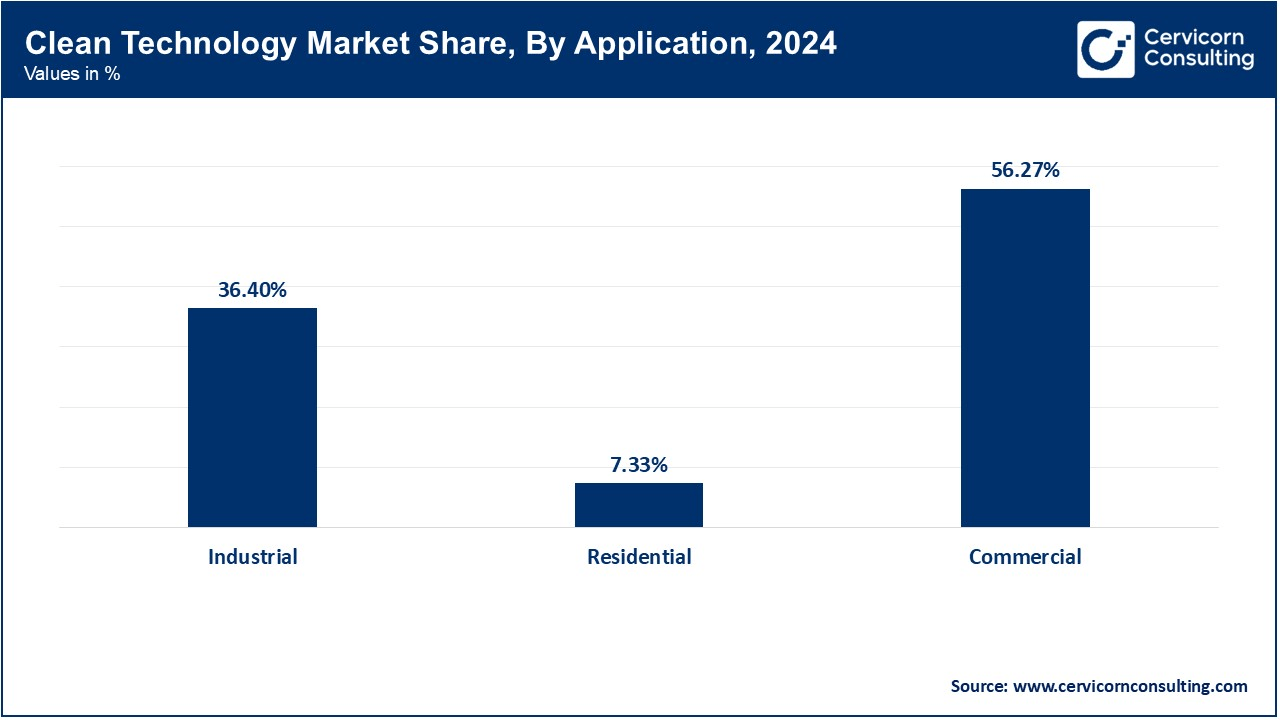

The clean technology market is segmented into type, application and region. Based on type, the market is classified into renewable energy technologies, energy storage solutions, energy efficiency solutions, water and waste management, agriculture and food systems, air and environment management. Based on application, the market is classified into industrial, residential and commercial.

Renewable Energy Technologies: The Renewable energy technologies segment has dominated the market in 2024. Renewable energy technologies include solar power, wind energy, hydroelectric power, bioenergy, and geothermal energy. Solar energy is widely adopted due to declining photovoltaic (PV) panel costs and increasing efficiency in solar cells. Wind energy, both onshore and offshore, continues to expand due to technological advancements in turbine design, allowing for higher energy yields. Hydroelectric power remains a significant contributor, particularly in regions with abundant water resources, while bioenergy and geothermal energy provide sustainable alternatives to fossil fuels. Governments worldwide are supporting the adoption of these energy sources through subsidies and favorable policies.

Energy Storage Solutions: Energy storage technologies are critical for balancing renewable energy generation and demand. This segment includes lithium-ion batteries, solid-state batteries, pumped hydro storage, flow batteries, and thermal energy storage. Lithium-ion batteries dominate due to their high energy density and declining production costs. Solid-state batteries are emerging as a promising alternative, offering improved safety and efficiency. Pumped hydro storage remains the most widely used large-scale energy storage solution, while flow batteries provide long-duration storage ideal for grid applications. Thermal energy storage is being increasingly utilized in commercial and industrial sectors to enhance energy efficiency.

Clean Technology Market Revenue Share, By Type, 2024 (%)

| Type | Revenue Share, 2024 (%) |

| Renewable Energy Technologies | 62.10% |

| Energy Storage Solutions | 13.40% |

| Energy Efficiency Solutions | 7.30% |

| Water and Waste Management | 8.20% |

| Agriculture and Food Systems | 3.40% |

| Air and Environment Management | 5.60% |

Energy Efficiency Solutions: This segment focuses on reducing energy consumption through innovative technologies, including smart grids, LED lighting, energy-efficient HVAC systems, building automation systems, and industrial energy management solutions. Smart grids enhance electricity distribution, reducing transmission losses and improving reliability. LED lighting has become the preferred choice for residential, commercial, and industrial applications due to its long lifespan and low energy consumption. Advanced HVAC systems optimize heating and cooling, while building automation systems integrate smart sensors and IoT to improve energy efficiency in offices, homes, and factories. Industrial energy management solutions enable manufacturers to monitor and optimize their energy usage, reducing operational costs and environmental impact.

Water and Waste Management: Water and waste management solutions include wastewater treatment, desalination, smart water grids, recycling technologies, and waste-to-energy solutions. Wastewater treatment facilities utilize advanced filtration and biological treatment processes to remove contaminants and enable water reuse. Desalination technologies are expanding in water-scarce regions to provide potable water from seawater. Smart water grids use IoT and AI to detect leaks and optimize water distribution. Recycling technologies help reduce landfill waste, with innovations in plastic recycling, electronic waste management, and circular economy initiatives. Waste-to-energy solutions convert municipal and industrial waste into electricity and heat, minimizing environmental pollution.

Agriculture and Food Systems: Sustainable agriculture and food technologies include precision farming, vertical farming, hydroponics, bio-based packaging, and alternative proteins. Precision farming leverages AI, IoT, and drone technology to enhance crop yield and reduce resource consumption. Vertical farming and hydroponics enable year-round food production in urban areas using minimal land and water. Bio-based packaging solutions, such as compostable materials, reduce plastic waste. The rise of alternative proteins, including plant-based and lab-grown meat, is addressing sustainability concerns and meeting consumer demand for environmentally friendly food choices.

Air and Environment Management: Technologies in this segment focus on improving air quality and reducing emissions, including carbon capture and storage (CCS), air purification systems, emissions monitoring, and sustainable transportation solutions. CCS technology helps industries capture and store COâ‚‚ emissions, preventing them from entering the atmosphere. Air purification systems, including HEPA filters and electrostatic precipitators, are increasingly used in urban areas to combat pollution. Emissions monitoring technologies enable governments and industries to track and regulate pollutants. Sustainable transportation solutions, such as electric vehicles (EVs) and hydrogen fuel cells, play a crucial role in reducing carbon footprints in the mobility sector.

Commercial: The commercial segment has dominated the market in 2024. The commercial sector includes office buildings, shopping malls, hotels, and educational institutions, adopting green building technologies, HVAC optimization, waste management systems, and EV charging stations. Green buildings incorporate energy-efficient designs, smart lighting, and insulation to minimize energy consumption. Advanced HVAC systems with smart controls optimize indoor climate while reducing electricity usage. Waste management systems in commercial establishments focus on recycling and composting to minimize landfill contributions. The rise in electric vehicle (EV) adoption has led to the installation of EV charging stations in commercial areas, encouraging the transition to sustainable transportation.

Industrial: The industrial sector is the largest adopter of clean technologies, integrating renewable energy, energy-efficient manufacturing processes, sustainable supply chains, and carbon capture solutions. Companies are investing in solar and wind energy to power factories and transitioning to energy-efficient machinery. Smart manufacturing, powered by AI and IoT, optimizes resource use and reduces waste. Sustainable supply chains focus on reducing emissions from logistics, while carbon capture technologies help industries comply with stringent environmental regulations. Industrial wastewater treatment and waste-to-energy solutions are also being widely implemented to improve sustainability.

Residential: Clean technology adoption in residential areas includes solar panels, smart home energy management systems, energy-efficient appliances, and water conservation solutions. Homeowners are increasingly installing rooftop solar panels to reduce electricity costs and reliance on fossil fuels. Smart home energy management systems integrate IoT to monitor and optimize energy consumption. Energy-efficient appliances, such as LED lighting, inverter-based air conditioners, and heat pumps, are becoming standard in modern homes. Water conservation solutions, such as rainwater harvesting and greywater recycling, help households reduce water wastage.

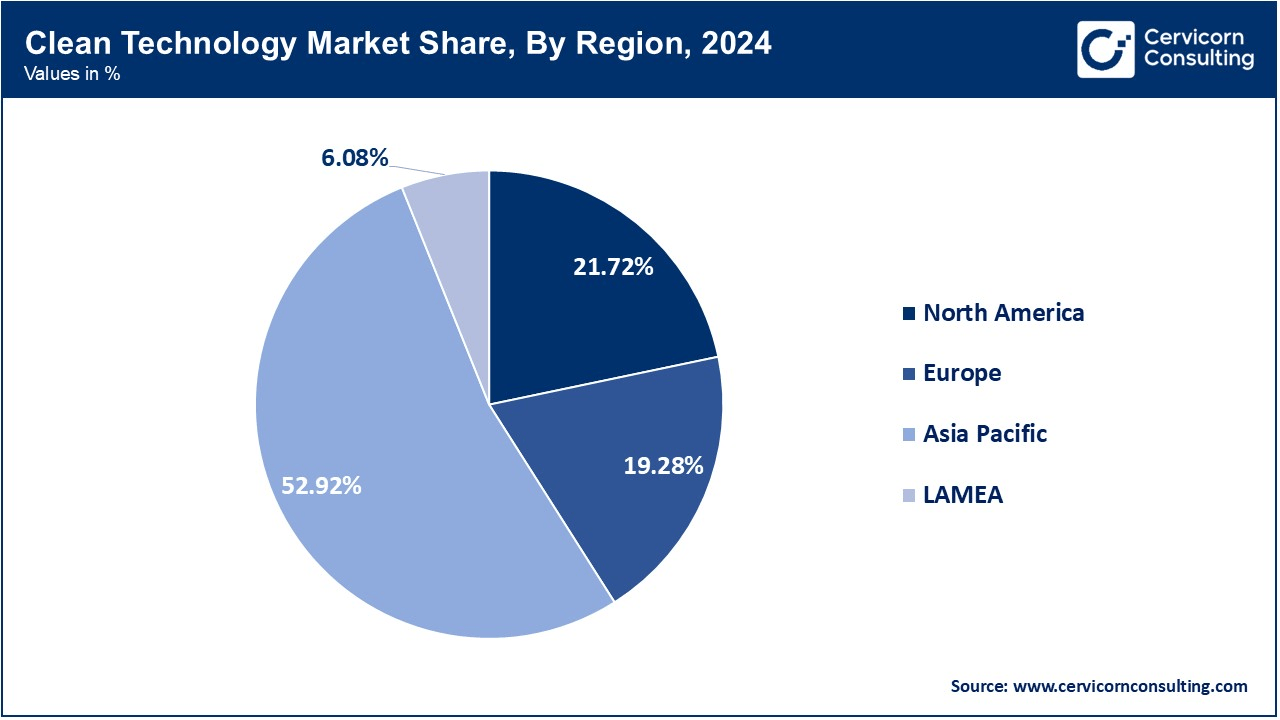

The clean technology market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA.

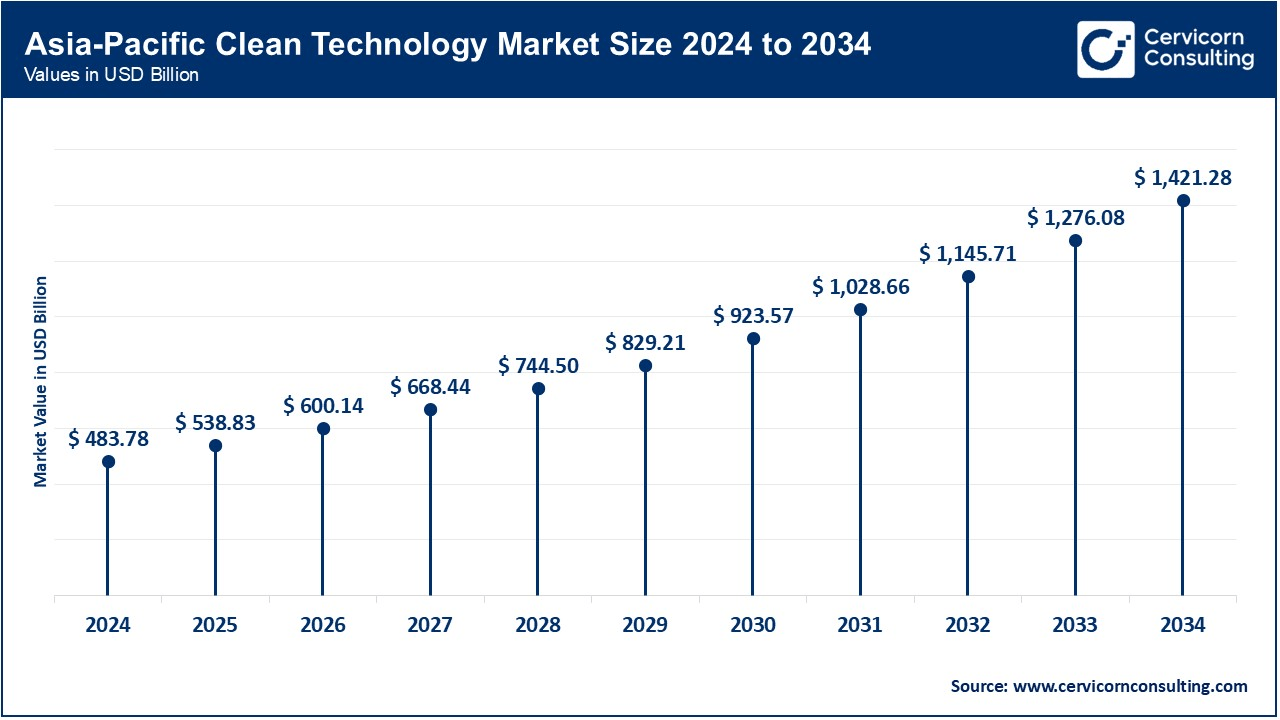

The Asia-Pacific clean technology market size was valued at USD 483.78 billion in 2024 and is poised to reach around USD 1421.28 billion by 2034. Asia-Pacific holding the highest market share in 2024. This dominance is driven by rapid industrialization, government initiatives for sustainable development, and increasing investments in renewable energy. China, India, and Japan are key contributors, with China being the largest producer and consumer of solar panels and wind turbines. India’s ambitious renewable energy targets and Japan’s advancements in hydrogen fuel technology further strengthen the region’s leadership. The adoption of energy-efficient solutions, smart grids, and electric vehicles is growing rapidly, supported by government policies, subsidies, and favorable regulations. The region’s expanding urban population and increasing awareness of environmental sustainability further accelerate the demand for clean technologies.

The North America clean technology market size was estimated at USD 198.56 billion in 2024 and is projected to hit around USD 583.34 billion by 2034. North America is a major market, driven by stringent environmental regulations, corporate sustainability initiatives, and significant investments in renewable energy and energy storage. The U.S. leads the region, with federal and state-level policies promoting clean energy adoption, carbon neutrality, and green infrastructure development. The increasing penetration of electric vehicles, advancements in battery technology, and widespread deployment of smart grids contribute to market expansion. Canada also plays a vital role, with a strong focus on hydroelectric power and green hydrogen projects. The corporate sector’s commitment to achieving net-zero emissions further propels North America’s clean technology growth.

The Europe clean technology market size was reached at USD 176.25 billion in 2024 and is poised to surpass around USD 517.81 billion by 2034. Europe represents a significant portion, backed by aggressive climate policies, stringent emissions regulations, and high renewable energy adoption. Countries like Germany, France, and the U.K. lead in wind and solar energy deployment, while the European Union’s Green Deal promotes sustainable energy and carbon neutrality. The growing electric vehicle market, circular economy initiatives, and increasing adoption of carbon capture technologies support the region’s steady growth. The presence of well-established clean tech companies and strong government funding for R&D further bolster Europe’s position as a key player in the global market.

The LAMEA clean technology market was valued at USD 55.58 billion in 2024 and is anticipated to reach around USD 163.29 billion by 2034. The LAMEA region is witnessing steady growth, driven by increasing investments in renewable energy, energy efficiency, and water conservation projects. Brazil, Mexico, Saudi Arabia, and the UAE are key contributors, with Brazil leading in bioenergy and hydropower production. The Middle East is focusing on solar energy and green hydrogen initiatives to diversify its energy mix, while Africa is expanding its solar and off-grid energy solutions to improve electricity access. Government policies, foreign investments, and growing awareness of climate change contribute to the rising demand for clean technologies across the LAMEA region. While the market share is relatively smaller compared to Asia-Pacific, North America, and Europe, LAMEA’s clean technology market is expected to grow at a moderate pace with increasing infrastructure development and regulatory support.

The clean technology market is highly competitive, with key players focusing on innovation, strategic partnerships, and sustainability initiatives to maintain their market positions. Companies such as Siemens AG, General Electric, and Schneider Electric are driving advancements in renewable energy and energy efficiency solutions. Tesla and Vestas Wind Systems are leading in electric mobility and wind energy, respectively, while Ørsted is pioneering offshore wind projects. ABB and Enphase Energy are expanding their smart grid and energy storage solutions to meet rising demand. First Solar and Brookfield Renewable Partners are investing in large-scale solar and hydroelectric projects. Meanwhile, NextEra Energy and Johnson Controls are focusing on grid modernization and building energy management. With increasing global emphasis on decarbonization, government incentives, and technological advancements, these companies are positioning themselves for long-term growth in the clean technology sector.

Market Segmentation

By Type

By Application

By Region