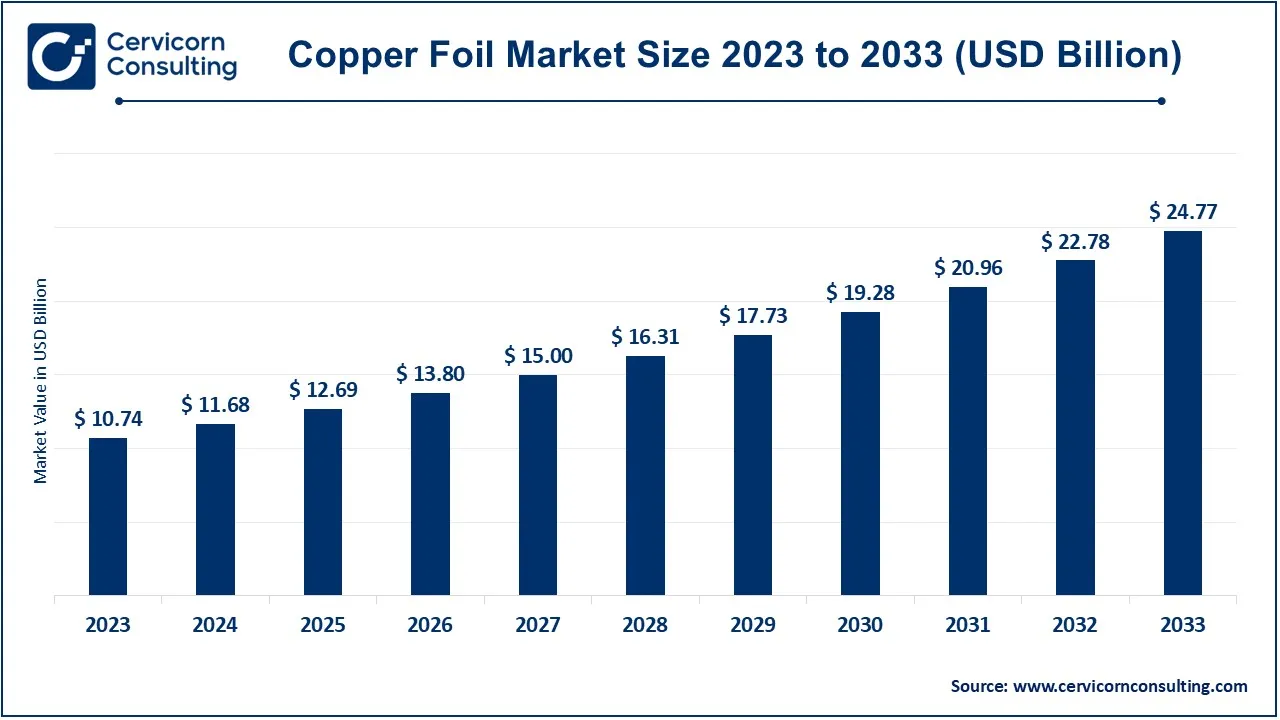

The global copper foil market size was valued at USD 11.68 billion in 2024 and is expected to be worth around USD 24.77 billion by 2033, growing at a compound annual growth rate (CAGR) of 8.71% from 2024 to 2033.

The copper foil market has been experiencing steady growth in recent years, driven by the increasing demand for electronic devices, renewable energy technologies, and electric vehicles (EVs). As technology continues to evolve, the need for high-performance copper foil in products like smartphones, laptops, and electric car batteries is expected to rise. Additionally, the rapid development of the renewable energy sector, particularly solar energy, has contributed to the growing demand for copper foil used in solar panels. The market is also benefiting from advancements in manufacturing processes, which allow for the production of thinner, more efficient copper foils for specialized applications. The Asia-Pacific region dominates the global copper foil market, with countries like China, Japan, and South Korea leading the production and consumption of copper foil. The region's robust electronics industry and growing automotive sector play a significant role in this dominance.

Copper foil is a thin sheet of copper metal that is commonly used in various applications, including electronics, manufacturing, and construction. It is typically produced through processes like rolling or electroplating, where copper is passed through rollers or electrodes to create a thin, flexible sheet. The thickness of copper foil can vary, but it is usually less than 0.2 millimeters. Copper foil is highly conductive, making it ideal for use in electronic devices, such as printed circuit boards (PCBs), batteries, and capacitors. It is also used in shielding for electromagnetic interference (EMI) and as a material for roofing, decorative items, and even art.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 12.69 Billion |

| Projected Market Size in 2033 | USD 24.77 Billion |

| Growth Rate 2024 to 2033 | 8.71% |

| Front-runner Region | Asia-Pacific |

| Fast-Developing Region | North America |

| Key Segments | Product, Thickness, Application, Region |

| Key Companies | Chang Chun Group, Circuit Foils, Doosan Corporation Electro-Materials, Furukawa Electric Co., Ltd., Lingbao, Lotte Energy Materials Consumption, LS Mtron, Nippon Denkai, Ltd., SKC, UACJ Foil Corporation |

The copper foil market is segmented into product, thickness, application, and region. Based on product, the market is classified into electrodeposited, and rolled. Based on thickness, the market is classified into 0.01 to 0.1 mm, 0.1 to 1mm, 1mm to 3mm, 3mm to 12mm, 12mm to 25 mm, and 25 mm to 60 mm. Based on application, the market is classified into circuit boards, batteries, electrical appliances, solar & alternative energy, medical, and other.

Based on product, the copper foil market is segmented into electrodeposited and rolled. The rolled segment has dominated the market in 2023.

Electrodeposited Copper Foil: This is a product whose microstructure is determined by an electrochemical deposit onto a surface or a rotating drum. Copper foil electrodeposited exhibits a characteristic smooth surface and uniformity in thickness. Such features make the very best for flexible printed circuit board (PCB) and lithium-ion batteries. Good mechanical strength, thermal and electrical stress factors, and the ability to handle high-frequency electronics were quite important for.

Rolled Copper Foil: Rolled copper foil is produced by feeding copper into a machine roll and performing a mechanical process.The result is a copper foil that is capable of bending and is sufficiently strong. The rolled copper foil is not typically as flexible as the electrodeposited foil, thus its applications include flexible printed circuits, automotive ACC components, and any other applications where flexibility and bending might be an issue. A smooth surface and great cracking resistance increase the performance it provides to electronic components, in fact, for reliability in aerospace and other defense applications.

Based on product, the copper foil market is segmented into circuit boards, batteries, electrical appliances, solar & alternative energy, medical, other. The circuit boards segment has dominated the market in 2023.

Circuit Board: Most often used in PCB manufacturing is copper foil, because it has a very common application in PCB, which enables the control of current in terms of radiated mechanical properties, flexibility, and thermal management capacity. Such conduction layer material works as interconnectors for PCB to allow effective transmission of electrical signals across the whole range of electrical apparatuses, from telephones to the largest industrial machines. The great increase of ultra-thin copper foil-thereby entering PCB production-due to the requirement of highly miniaturized yet functional electronic devices.

Batteries: The basic component for anode in lithium-ion batteries, working in an electric vehicle and an energy storage system, is copper foil. The greater the conductivity, the more or less current that can flow, thus improving efficiency and allowing for longevity. With undoubted growth in electric vehicles across the world-production launch, the favorable demand for copper foil for batteries has been received.

Copper Foil Market Revenue Share, By Application, 2023 (%)

| Application | Revenue Share, 2023 (%) |

| Circuit Boards | 60% |

| Batteries | 19% |

| Electrical Appliances | 8% |

| Solar & Alternative Energy | 4% |

| Medical | 6% |

| Others | 3% |

Electrical Appliances: Motor, transformers, and wiring systems, among other aspects of electrical appliances, receive support and enhancement using this substance, thus allowing for efficient conductivity and, hence, heat dissipation during the operation of the electrical appliance: this makes copper foil truly central in motors, transformers, and wiring systems by combining high conductivity and heat management to ensure effective and long-running operation by the appliance.

Renewable Energy: In the renewable-energy sector, copper foil makes away with solar panels and energy storage solutions. Its brilliant silver-like conductivity makes it the most efficient conductive path for bringing in energy while hanging on to it, which makes it irreplaceable in solar cells, energy-storage solutions, and wind turbines. The shift towards alternatives worldwide is the biggest driver for copper foil applications within this niche market.

Medical: Owing to its remarkable antimicrobial characteristics and a seemingly very efficient conductive nature, copper foil is steadily being incorporated into medical devices and equipment. It finds applications in sensors, diagnostic devices, and flexible electronics in fields that are wearable-based medical applications. Market progresses in healthcare technologies.

Others: Besides other uses, copper foil is also available in quite a few other industries, such as aerospace, automotive, and telecommunications. Its versatility, durability, and electrical properties make it a viable manufacturing material for components such as antennas, shielding materials, and electric motors. With new technologies, these special applications will continue growing in step with new technologies in various industries.

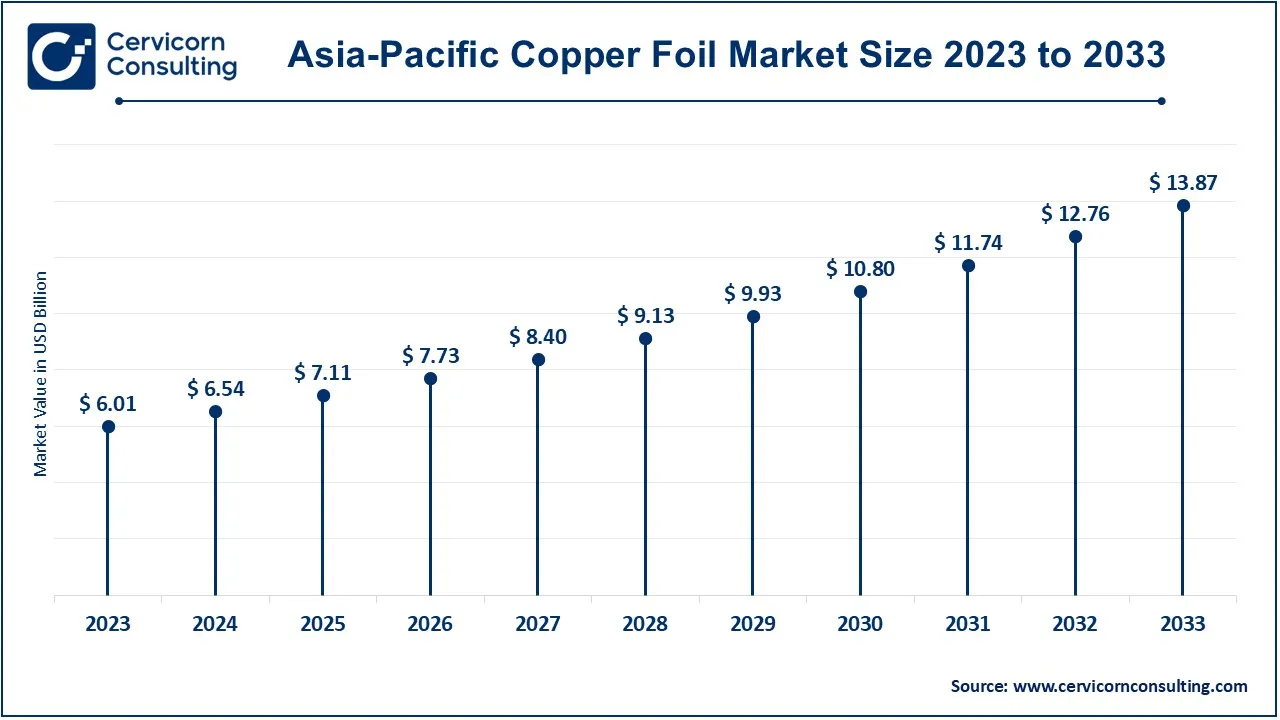

The copper foil market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The Asia-Pacific has dominated the market in 2023. Here’s an in-depth look at each region

The Asia-Pacific copper foil market size was valued at USD 6.01 billion in 2023 and is expected to reach around USD 13.87 billion by 2033. Asia Pacific has captured the largest share in the market. The major reasons are that the electronics and automotive manufacturing hubs are located in China, Japan, South Korea, and Taiwan. It is the largest production region for PCBs, semiconductors, and lithium-ion batteries, all of which need copper foil. The expected fastest growth in the electric vehicle (EV) sector, spurred by government incentives along with rising consumer demand, comes to bear on increased need for copper foil. Also, the renewable energy sector is also revitalizing in the region due to increasing installations of solar power systems. The industry is competitive enough, with several local players, but the growth is up to expectations with no deterrence.

The North America copper foil market size was estimated at USD 2.47 billion in 2023 and is projected to hit around USD 5.70 billion by 2033. The demand for copper foil is robust in North America, supported chiefly by the electronics, automotive, and renewable energy sectors. A well-developed infrastructure coupled with a growing dependence on technological innovation is the driving factor in the use of copper foil for advanced electronic devices, including circuit boards and lithium-ion batteries. The growing EV industry further authors needs for interactions with copper foil as a notable component in EV batteries. Moreover, the renewable energy sector, especially solar, substantially accounts for market growth. However, rising production costs as well as a never-ending inflow of cheap imports, in particular from Asia, may restrict market growth.

The Europe copper foil market size was estimated at USD 1.72 billion in 2023 and is predicted to surpass around USD 3.96 billion by 2033. The Europe is mainly driven by increasing environmental directives and the commitment of this region to renewable energy and electrification. Other factors contributing to growth are the rise of the automotive industry with a focus on electric vehicles (EVs) and the growing acceptance of solar power systems. Europe has also become a target area for electronics production, which stimulates the consumption of copper foils in printed circuit boards (PCBs). On the other hand, the area faces challenges such as continually fluctuating raw material prices and high energy costs which in crystal clear terms impacts the profitability of copper foil producers. While Europe seems to remain one of the most significant markets, especially concerning sustainable energy and high-tech applications.

Copper Foil Market Revenue Share, By Region, 2023 (%)

| Region | Revenue Share, 2023 (%) |

| North America | 23% |

| Europe | 16% |

| Asia-Pacific | 56% |

| LAMEA | 5% |

The LAMEA copper foil market was valued at USD 0.54 billion in 2023 and is anticipated to reach around USD 1.24 billion by 2033. The copper foil market in LAMEA is growing steadily, supported by infrastructure development, the automotive industry, and investments in renewable energy projects. Latin America, particularly Brazil and Mexico, has seen increasing demand for copper foil in the electronics and telecommunications sectors. In the Middle East, the rising focus on solar energy is driving demand for copper foil in photovoltaic applications. Africa, with its growing telecommunications industry, also contributes to market growth. However, challenges such as political instability, infrastructural constraints, and a lack of advanced manufacturing capabilities in certain regions may hinder market expansion in LAMEA.

The market of copper foil in general, is clouded with a handful of major players such as Chang Chun Group, Circuit Foils, Doosan Corporation Electro-Materials, Furukawa Electric Co., Ltd, and others. These companies are instrumental in advancing the technology used in copper foil production, especially for critical applications such as printed circuit boards (PCBs), lithium-ion batteries, and electronics manufacturing. Focusing their innovation on the product techniques of production, material properties, and energy efficiency ensures that high-quality copper foils meet strict requirements in electric vehicles, renewable energy, and more complex electronics. Other players also invest in R&D to remain competitive and increase their capacities of production as well as ensure sustainable manufacturing processes to fulfill market demand across the globe.

CEO Statements

Chiang Ping Chien – CEO of Chang Chun Group

Kim Jong-Hyun, CEO of Doosan Corporation Electro-Materials

Takashi Imai, CEO of Furukawa Electric Co., Ltd

The recent expansion , collaboration, and investment indicate the rapid growth and cooperation in the copper foil industry. Top organizations, such as Chang Chun Group, Circuit Foils, Doosan Corporation Electro-Materials, Furukawa Electric Co., Ltd, these companies are actively engaged in developing advanced manufacturing techniques, enhancing product quality, and increasing production capacity to meet the rising demand in various applications, particularly in the electronics and electric vehicle sectors. These initiatives not only aim to improve efficiency and reduce costs but also focus on sustainability practices to minimize environmental impact. Some notable examples of key developments in the copper foil industry include:

These developments highlight significant advancements in the copper foil sector, showcasing innovative technologies that enhance efficiency in manufacturing processes, including electroforming and roll-to-roll production techniques. These technologies enable higher precision and consistency in the production of copper foils, essential for applications such as printed circuit boards (PCBs), batteries for electric vehicles, and flexible electronics. Additionally, advancements in surface treatment and coating technologies contribute to improved conductivity and thermal management, addressing the growing demands of the electronics industry and supporting the transition to greener technologies.

Market Segmentation

By Product

By Thickness

By Application

By Region